Big Data Analytics in the Banking Market

Every day, we produce huge amounts of data. Whether it is a web page we open or a transaction we make, all of these actions sum up into 2.5 quintillion bytes of data daily. Logically, such huge amounts of invaluable information can be analyzed to come to all kinds of conclusions that will be helpful in almost any industry, including the banking market.

Importance of Big Data Analytics

Big data analytics has numerous benefits specifically for banks. Big data analytics can give insights into many aspects of a person's life including their needs, preferences, and lifestyle. This allows banks to personalize their services to meet the needs of every individual. Moreover, big data analytics can also improve the extrapolative power of risk models that financial institutions and banks use.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

But this is not all. Some other benefits of big data include:

- A Full View On Your Business: By getting such crucial information like customer behavior

patterns and internal process efficiency, you can get a full picture of what your business is and how and

where it can be improved. You can even obtain broader market trends and as a result, make informed,

data-driven decisions to ensure the safe and effective functioning of your business.

- Optimization Of Internal Processes: With the help of machine learning and artificial

intelligence (AI), you can streamline and optimize all of the internal processes in your business. This will

result in reduced operating costs and a significant boost in performance.

- Cyber-Security Enhancement: By using intelligent algorithms, you can easily prevent potentially malicious actions and detect fraud beforehand. This will allow you to enhance your cyber-security and reduce any minor and major risks.

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

Uses & Tools

Big data analytics has many uses and there are numerous ways you can implement it to improve certain aspects of your business. Here's how it has been used in banking so far:

- Personalized Customer Experience: Customer experience is perhaps the most important aspect of any business. Big data analytics can be used to improve it tremendously. By having a complete customer profile and product engagement data, you can even prevent predict and prevent churn. If you analyze the data of previous transactions, you can identify accounts that are more likely to close in the upcoming months and take preventive actions.

- User Segmentation & Targeting: Big data lets you plan targeted marketing campaigns that will generate additional revenue. By analyzing data, you can detect problems in your product targeting and understand your customers' needs. This will help you fix the existing issues in the best way possible. Collecting customer feedback from social media can let you pinpoint the dissatisfaction of your clients with certain aspects of your business and quickly address them.

- Business Process Optimization & Automation: Some critical processes in bank operations can easily be automated to reduce the risk of failure by eliminating the human factor. Around 30% of all work in banks can be automated through technology such as machine learning and AI. These include algorithmic trading, commercial-loan agreements interpretation, and more. With the help of big data analytics, financial institutions can decrease the time, effort, money, and amount of errors associated with the human factor.

- Improved Cyber-Security & Risk Management: Big data analytics can also be used to analyze the behavior patterns of bank employees in order to recognize potential risks, including fraud or even terrorist activities. As mentioned above, cyber-security is the most burning issue in the banking sphere, and big data analytics can substantially improve it.

- Better Employee Performance & Management: In addition to monitoring the suspicious actions of employees, big data can also help get insights into the day-to-day performance of every worker in real time. The performance of different branches can also be analyzed and their productivity measured.

|

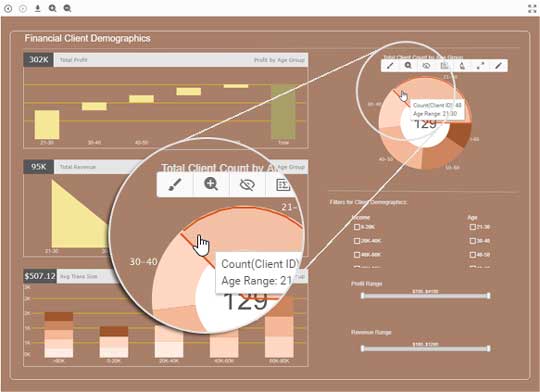

View live interactive examples in InetSoft's dashboard and visualization gallery. |

To achieve better results while collecting big data, you should keep in mind some things such as the circumstances in which you are collecting the data, the specific area, and the type of data you are collecting.

Challenges of Big Data Analytics

Just like anything else, big data analytics has its challenges. They are certainly not as numerous as the benefits, but they are still quite prominent and should be addressed:

- The Legacy Systems Problem: The banking sector has never been fast to innovate with 92 out of the top 100 world leading banks still relying on IBM mainframes in their operations. Obviously, the legacy systems can't keep up with the ever-growing workload of big data. The outdated infrastructure simply cannot do what is required of them. This means that very soon, banks will either have to grow their processing capacities to rebuild their systems entirely.

- The High Risks: Collecting data always comes with a risk, and this risk is much higher with bigger amounts of data. Cyber-security remains the main issue for financial institutions across the world. With outdated technology they use to process, analyze, and store data, there will definitely be unwanted incidents sooner or later.

- The Big, Big Data: Big data is getting too big. With the amounts of data constantly growing, the percentage of useless data continues to be extremely high making the relevant data very hard to find and separate from the meaningless one.

Read what InetSoft customers and partners have said about their selection of Style Scope for their solution for dashboard reporting. |

Trends & Predictions

The future of big data analytics looks bright. With everything mentioned above, there is no denying that we have only scratched the surface of its true potential and have you to find ways to effectively use it in different spheres.

Financial institutions need to reevaluate their ways of operation and renovate their outdated technology in order to keep up. Most banks agree that big data is crucial for their success, and this trend is said to grow in the years to come.