What Are The Financial Metrics That A Startup Must Track

Keeping close track of financial metrics is a crucial aspect of running a successful startup. Leveraging tools like fractional CFO services can further enhance this process, offering entrepreneurs valuable insights into the health and performance of their startups and enabling them to make well-informed operational decisions.

Startups are known for their groundbreaking ideas and disruptive business models, yet also have an alarming failure rate. One of the primary factors of failure is ineffective financial management. As a way to prevent this, startups should track financial metrics regularly to maintain financial stability.

In this article, we'll discuss why tracking financial metrics is so important and understand how the metrics can assist startups to effectively manage finances.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Importance of Tracking Financial Metrics

Tracking financial metrics provides rather important advantages that each startup owner can benefit from. Entrepreneurs can gain insights into their operations, compare performance against industry benchmarks, and identify optimization areas by regularly monitoring financial metrics.

As a startup owner, aiming for long-term financial stability, you should monitor how your finances move within the company. This practice gives valuable insights into your business operations and helps you make informed decisions. Here we discuss some of the key metrics that each startup owner should track:

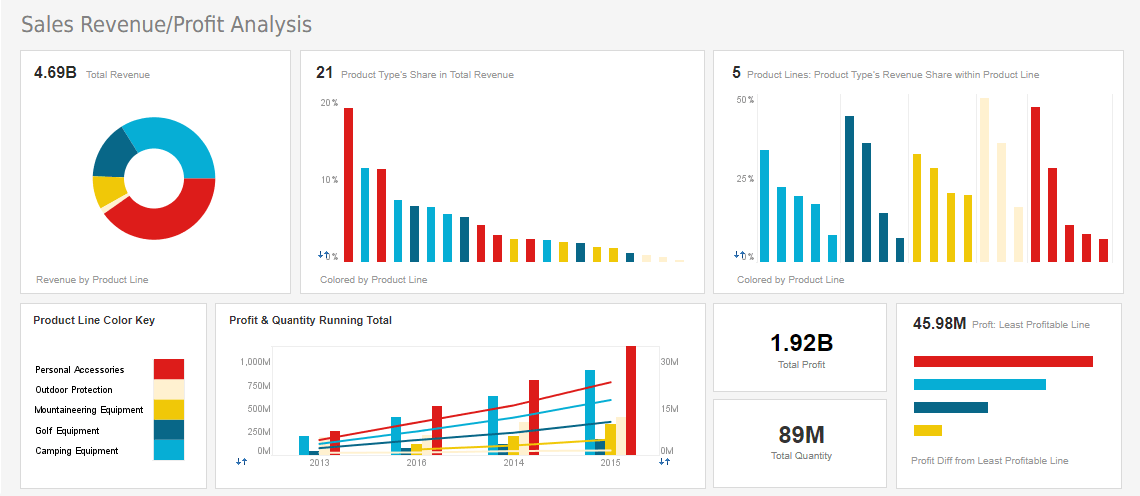

Revenue

Revenue is an essential financial metric as it measures how much money a business brings in by selling products or services to customers and is calculated by multiplying the number of goods or services sold by their respective prices. Tracking revenue provides you with invaluable insight into the performance of your business, including:

- Understanding the financial health: By tracking your startup revenue, you will be able to understand whether your startup is able to grow, allowing you to make intelligent decisions about resource allocation, pricing, and other key business issues.

- New opportunities: By showing consistent revenue growth, you can draw investors' interest and secure funding. In addition, you will find opportunities to expand your business and get into new markets. Additionally, understanding these metrics can be invaluable if you're planning to sell a business, as strong financial performance often attracts potential buyers and increases the value of your startup.

- Operational efficiency: By comparing revenue to expenses, you can determine whether you are operating at a profit or loss and identify areas where you can improve. You will find out which products and services perform better and which one seeks improvement.

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

Profit Margin

Profit margin is the next key metric that shows the percentage of revenue left over after deducting all costs incurred by a business, after calculating its revenue and deducting all expenses. Tracking this metric is not less essential than the revenue as it allows you to assess your profitability and cost structure as well as identify areas in which costs could be cut or increased in order to boost profits. By tracking profit margins, you will identify areas for optimization and cost reduction within your operations, marketing, resource allocation, and more.

Cash Flow

Cash flow refers to the flow of funds into and out of a business, providing enough funds for covering expenses and investing in growth opportunities. Maintaining positive cash flow allows business owners to meet financial obligations such as bills and salaries while investing in opportunities without resorting to outside sources of funding. Tracking cash flow also provides you with an insight into inventory levels, credit extended to customers, and negotiating favorable payment terms from vendors - ultimately contributing to the long-term sustainability of the business. Positive cash flow will not lead your business to bankruptcy.

Burn Rate

Burn rate measures the rate at which a business spends its cash reserves to cover expenses. As a startup owner, you need to understand your burn rate so you can quickly gauge how fast your cash reserves are diminishing and adjust spending and revenue generation strategies accordingly to maintain financial stability for your enterprise. A high burn rate means that your company is spending its cash reserves quickly and may run out of funds soon. The low burn rate means that your company spends at a slower pace and may reach significant profitability. Always keep your burn rate low.

Gross Margin

Gross margin measures the difference between revenue and cost of goods sold for any given business, which indicates how much profit the business is making on each sale. By closely tracking gross margins, you can identify areas for improvement to increase margins and maximize profits. This includes pricing decisions or identifying and using industry benchmarks to compare their business's gross margin against competitors.

Customer Acquisition Cost (CAC)

CAC refers to the cost associated with customer acquisition. Tracking CAC is another essential metric for startups as it gives an accurate representation of how much is spent acquiring new customers. To calculate the CAC metric, you need to divide the total cost of acquiring customers by the number of customers acquired during a specific period. It will help you adjust your marketing and sales strategies accordingly.

Understanding CAC can also help optimize customer lifetime by retaining high-value customers and decreasing churn. Lowering CAC and increasing customer lifetime value enables startups to increase profitability while driving long-term growth.

Lifetime Value (LTV)

LTV measures the total revenue a customer will generate over their lifetime with a business. Tracking LTV will help you understand the long-term value of your customers and target efforts to retain those with the highest margins for maximum revenue growth. By optimizing LTV for your startup, you can improve customer acquisition strategies, increase profits and achieve sustainable growth over time.

|

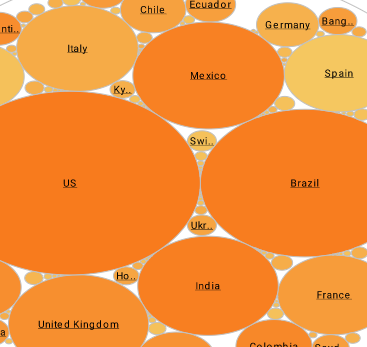

View live interactive examples in InetSoft's dashboard and visualization gallery. |

Working Capital

Working capital refers to the funds available to a business for daily expenses. It's calculated by subtracting current liabilities from current assets. Each startup needs working capital as it ensures there are enough funds for payroll, rent payments, and inventory purchases.

Startup owners should understand the significance of effectively managing working capital as it helps keep financial security and avoid bankruptcy. Here are some steps for successful management:

- Reducing inventory levels: Startups must maintain optimal inventory levels to minimize storage costs and free up cash for other expenses. By decreasing inventory levels, you can increase cash flow while protecting working capital.

- Improving cash flow: You can increase your startup cash flow by optimizing payment terms, collecting receivables faster, and negotiating better payment terms with suppliers. By improving your cash flow numbers, you can have increased working capital while maintaining financial stability.

- Managing expenses: You should carefully manage your expenses to prevent overspending and protect your working capital. By cutting unnecessary expenses, you will increase cash flow while simultaneously maintaining financial security.