How Loan Originators Use Data Analytics

Fintech companies and NBFCs are leveraging cutting-edge predictive data science to revolutionize the lending process. With automated risk analysis and lightning-fast loan disbursements, these innovative organizations can now make informed decisions in record time, resulting in reduced risks for all involved.

With modern lending software and apps, borrowers can quickly apply for loans from anywhere. All it takes is a few taps on their phone. The algorithm powering this service uses predictive data analytics to determine if applicants qualify according to pre-set criteria. Once approved, funds are credited almost instantly, so you'll never miss out when times call for swift access to cash.

Let's take a look at how predictive analytics is assisting loan firms in making better decisions.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Data Mapping for Underwriting

NBFCs and financial institutions deploy their well-honed procedures for lending money to borrowers. To ensure a clear audit trail of required documents, these organizations use third-party tools and processes before disbursement - all in the name of stringent documentation needs.

Data mapping enables companies to make a unified compilation of all their structured and unstructured data for detailed analysis. This assembly can include everything from internal application information, third-party integrations, and credit scores to even in-depth borrower details - giving businesses the insights they need with just one glance.

To ensure successful loan disbursement, financial institutions must carefully analyze and map all data related to the borrower's assessment. It includes cleansing external information so that it meets lenders' standards for qualification. By doing this, they can make sure that only genuine applications are approved.

Financial institutions employ a range of loan types to assess risk and provide the appropriate capital. By using data mapping, these establishments can identify relevant information within an organization's goals and expunge any that are no longer necessary for their model.

Fraud Detection

By leveraging automation and third-party data, lending software makes loan disbursal easier than ever before, typically less than 10 minutes. It means financial institutions have no reason to worry about risks, liabilities, and contingencies. Not only that, but they can also protect themselves against fraud through identity verifications provided by the same platform.

With the ease of mobile technology, borrowing is becoming even more convenient! When you submit your loan application via a handheld device, it's verified and authenticated right away to make sure that everything checks out. From there, advanced algorithms use multiple parameters such as identity details, banking history, and credit ratings to determine if disbursement is appropriate - giving you access to funds faster than ever before.

With fraud detection measures in place, it's possible to not only speed up the loan process but also safeguard against any malicious use of technology. Thanks to these advances, identity spoofing behaviors won't get past us.

Financial institutions can assess the creditworthiness of a borrower quickly and efficiently with digital automation. It helps reduce the risk for companies, as well as ensuring borrowers can get instant credits digitally - streamlining the process more than ever before. Careful verification of identity, criminal records, employment details, and compensation abilities allows them to make informed decisions when approving loans.

|

View live interactive examples in InetSoft's dashboard and visualization gallery. |

Risk Selection Analysis

Accurate predictive assessments of borrowers are essential for banking institutions, and it all starts with rigorously examining the risk factors. To determine if a loan should be issued, banks must carefully consider factors such as the type of loan, industry sector, size of the organization, borrower history reviews, and credit checks, in addition to obtaining employer details.

Predictive analytics empowers underwriters by analyzing loan applications and making risk-informed recommendations. Automation accelerates the process, allowing supervisors to swiftly approve or deny a request with details on any associated risks - while even permitting auto-approvals in certain cases.

Technology is known for simplifying time-consuming processes, including calculating risk assessments. Lending companies can benefit from utilizing an innovative approach to decision-making - one that employs analytical models and advanced machine learning techniques. These self-evolving systems increase their knowledge base and boost confidence levels in final loan disbursements.

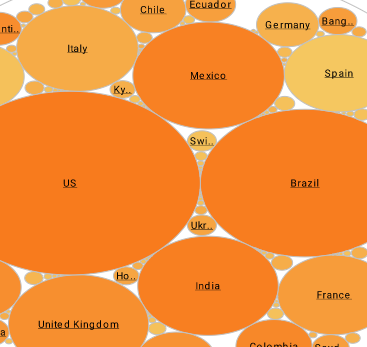

By leveraging customer data, the likes of Alibaba, an e-commerce giant, are creating revolutionary pathways for financial inclusion. This cutting-edge approach enables them to accurately gauge creditworthiness and extend appropriate lines of credit to their customers.

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |

Bad Debt Analysis

To ensure its accuracy, the training models used in lending software undergo extensive learning. Through back-testing using data from past borrowers who have defaulted on loans and analyzing historical trends of defaults, lenders can fine-tune their algorithm for greater precision when it comes to loan decisions. This revolutionary model leverages data from various lending sources to develop powerful insights into loan disbursement decisions. Through careful scrubbing and analysis, the algorithm can analyze patterns in customer defaults - allowing lenders to make better-informed choices when granting loans.

With the help of in-depth analysis and data from third-party lenders, lending companies can develop strong models with safeguards that reduce instances of borrowers not paying their loans. It leads to improved loss ratio results for businesses. To effectively manage bad debt, financial institutions draw on a wide array of user-specific information to build an accurate picture. It includes analyzing borrowers' spending habits and bank balances, as well as their credit scores and mobile phone usage patterns.The training data generated is then used by lenders to assess the performance of lending algorithm models compared against industry averages to ensure they remain ahead of the game.

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

Collateral Value Assessment

To ensure that borrowers acquire fair loan terms, lenders must properly assess the present-day value of collaterals and mortgages. This assessment is conducted using an advanced lending algorithm that calculates the worth of properties or assets before any funds are released. Despite market uncertainty, technology can help financial institutions accurately assess the value of loan collateral.

It helps reduce risk and ensures that large loans are secured by assets with sufficient foreseeable worth. Leveraging technology can help reduce the risks of potential threats by bringing difficult issues to light. It allows businesses to have more accurate balance sheets and fewer customer defaults, leading ultimately to an improved bottom line.

Read what InetSoft customers and partners have said about their selection of Style Scope for their solution for dashboard reporting. |

FinTech Benefits from Analytics

The world of finance is being revolutionized by the increasing usage of digitization and innovative technologies. These advancements provide fintech companies with quick access to loan solutions, allowing them to offer customers an efficient application process without extensive paperwork or lengthy procedures - enabling increased scalability for operations.