Ways Travel Agencies Use Dashboards

The corporate travel industry isn't one to adopt changes quickly, and that's understandable. There is no point in experimenting and risk making losses when everything is still in order and works perfectly. On the other hand, leisure travel is fast-moving and is adopting changes such as mobile payment, customer booking tools, etc. effectively drifting from traditional travel agencies' operations.

Although the management of business travel is hesitant, the travelers themselves aren't. In no time, millennials will make up the majority of the workforce. These people commonly plan their trips with their smartphones, trust AI to make critical analytical decisions, digitally manage their expenses, embrace and learn new technologies, etc. These people also demand their employers to be like they are.

While on business trips, most of these employees contact their office with mobile apps, and the companies cannot track them and give them the needed assistance for the journey should they need it, because they lack the technology.

In order to address the demands of travelers and adapt to the new behavior, the existing solutions are divided into two classes:

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

- Independent software vendors - these are companies that provide self-service solutions for managing travel expenses, invoicing, booking, support dashboards, and automating the overall travel management process of the organization's travel.

- Travel management organizations - these companies offer everything as the one above and other services such as travel agent access, program building for custom travel, consultancy, etc.

To optimize corporate travel management and ensure that the travel agency implements relevant dashboards, here are three ways to ensure this.

Self-service travel management

The growth of mobile technology, coupled with mobile internet speed, has made enhanced connectivity easier. We can now use apps to order coffee just before the line and for flight check-in from home. There is rising confidence among travelers too to make their purchases online, change the itinerary, book with an app, etc. All of this, instead of making a call to someone in an office. They love that autonomy. However, it does not mean that these business travelers are willing to evade corporate policy and remain independent during their travels. They like to have some control over their journeys.

Also, this doesn't make the role that travel management companies play to become obsolete. As they have more time, travel agents can research new technologies and implement them. They can also update their travel policies and explore their travelers' behavior with analytics so that they can apply personalization in future cases. Also, an employee can't solve all of their travel problems with their smartphones. So, a travel manager is still needed to deal with the disruptions and notify them about the sudden turn of events.

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

Using technology to manage travel risk and duty of care

Duty of care refers to the legal and moral obligation that a company has to provide safety for their employees and protect them while working in remote places. To properly execute the duty of care, companies have to implement solutions for travel risk management. However, these measures, today, are not so much concerned with monitoring them and providing security. It is more about preparing the traveler by educating them about the trip.

In the last few years, traveling has been associated very strongly with risks such as changes in regulation, natural disasters, terrorist attacks, strikes, etc. These are the commonest disruptors preventing business travelers from getting to their destination soon enough and can also pose some danger to their life and health.

When it comes to using business travel technology to streamlining the process of risk management, here's how organizations can do it.

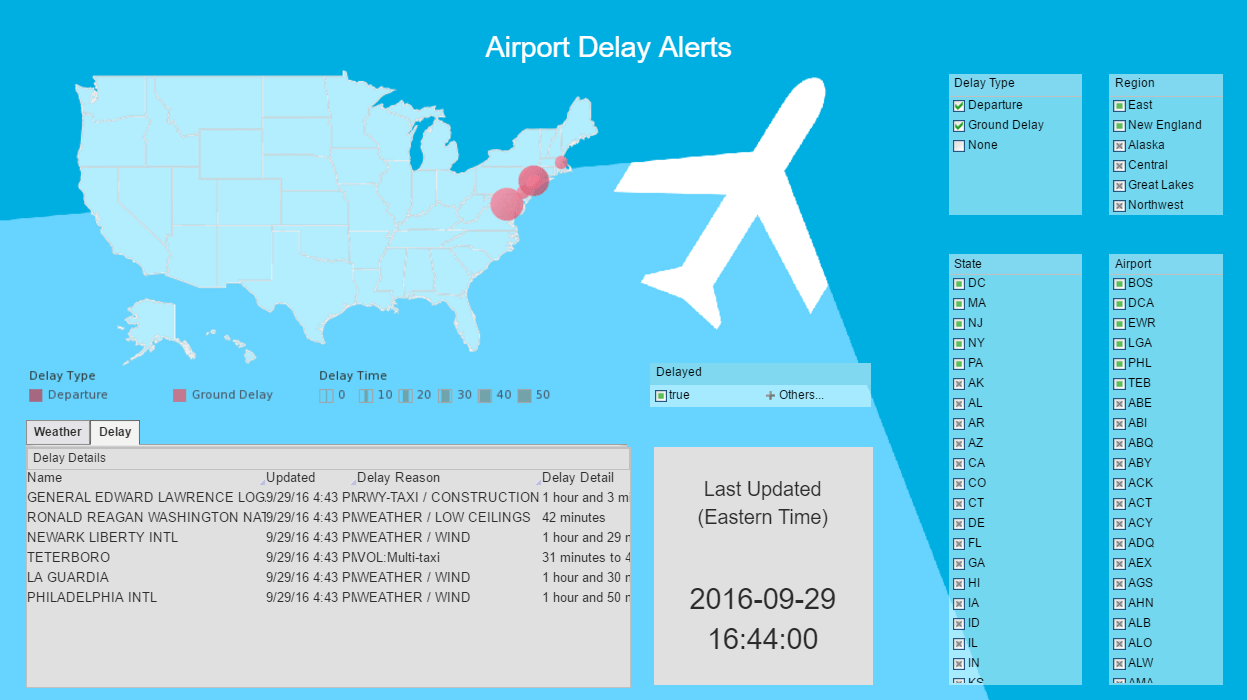

- Using real-time alerts

Travel agents have to be notified promptly about any emerging risks so to react quickly following the established procedures.

- Collect historical data

Records of past risks and disruptions are useful for evaluating future dangers. Then you'll be able to distribute the data to necessary departments where they are needed.

- Protect third-party travelers

There are times when organizations are responsible for looking after their partners and contractors when they travel on the company's behalf. They can establish a tool to monitor and communicate and build a profile for them and track them like they are the company's employees.

No matter how effective the plan you have in place is, your employees must know the company's procedures for when there is a disruption. Even if it's just a flight delay or some other more severe obstruction, the traveler has to know that the company is on the issue, and they are not abandoned. That's why it is essential to establish a platform for communication convenient for both employees as travel managers, and both can use it well.

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |

Embrace convenient and secure virtual payments

While other services are already using virtual paying options, corporate travel is still lagging. According to the latest research, this is mostly due to the ignorance of the differences between virtual paying options and credit cards.

Mobile wallets like Samsung Pay and Apple Pay use NFC technology (Near field communication) for making contactless payments. You only hold your wearable device or smartphone near a compatible device or a terminal. This process is even pretty similar to using plastic cards. You can store all your personal and corporate cards, virtual money in the mobile wallet.

While different types of payments have their advantages, here are ways that the mobile payment can completely change corporate travel management.

- Fraud and risk prevention

The loss of credit cards in travel is not something that people have to worry about seriously and the use of their personal cards. Virtual money also allows them to create the virtual card numbers which expire after some amounts have been spent or after an event to ensure that they follow the corporate policies. This will prevent fraud, theft, and even misuse by the traveler.

- Improved reporting and expense management

Agents can keep the travel data together with virtual payments without necessarily dealing with different data sources and bills. All the expenses are in a real-time reporting tool, which they can link to GPS to create a very sophisticated report. This saves the time of both the agent and traveler as it streamlines the expense management.

- Paying third party travelers

The people traveling on behalf of the company might not be employees and can't get corporate credit cards. In this case, the manager can generate a virtual card number with ease and without risk for them.

Read what InetSoft customers and partners have said about their selection of Style Scope for their solution for dashboard reporting. |

The Bottom Line

Both travelers and travel management companies will benefit from the corporate travel agencies adopting the technology. For instance, employees can easily make payments without holding cash or even paying with their money. It is also easier for managers to get more accurate data with simpler expense management.