Searching for a BI system?

|

Don't want to be saddled with a massive BI software deployment that hogs resources and demands a major hardware investment? |

|

Don't want to have to figure out which BI application in the solution is the right one to use for particular dashboard, report, or analysis? |

|

InetSoft offers a small-footprint, full-featured BI platform that can be deployed on commodity servers. The single Web-based application provides a streamlined, intuitive interface for all users, business executives and database analysts. |

|

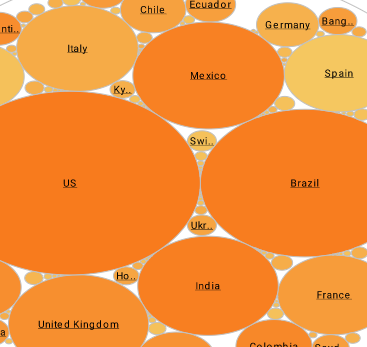

As an innovator in BI products since 1996, InetSoft's award-winning software has been deployed at thousands of organizations worldwide and integrated into dozens of other application providers' solutions serving vertical and horizontal markets of their own. |

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

What KPIs and Metrics Do Venture Capitalists Track for Business Intelligence?

Venture capitalists (VCs) play a crucial role in the startup ecosystem by providing funding and strategic support to early-stage companies with high growth potential. To make informed investment decisions and maximize returns, VCs track a variety of key performance indicators (KPIs) and metrics. These indicators help VCs assess the financial health, growth trajectory, and overall performance of portfolio companies. Here are some of the KPIs and metrics commonly tracked by venture capitalists for business intelligence:

- Revenue Growth Rate:

- Definition: Measures the percentage increase in a company's revenue over a specific period, typically on a quarterly or annual basis.

- Performance Insights: A high revenue growth rate indicates strong demand for the company's products or services, effective sales and marketing strategies, and scalability of the business model. Rapid revenue growth is often associated with successful startups poised for expansion and market dominance.

- Customer Acquisition Cost (CAC):

- Definition: Calculates the average cost incurred by the company to acquire a new customer, including sales and marketing expenses.

- Performance Insights: Monitoring CAC helps VCs assess the efficiency of customer acquisition efforts and the scalability of the company's growth model. A low CAC relative to customer lifetime value (CLTV) indicates efficient customer acquisition strategies and potential for sustainable growth.

- Monthly Recurring Revenue (MRR):

- Definition: Measures the total revenue generated from subscription-based products or services on a monthly basis.

- Performance Insights: MRR provides insights into the predictability and stability of a company's revenue stream, particularly for software-as-a-service (SaaS) businesses. Increasing MRR indicates customer retention, upselling opportunities, and the overall health of recurring revenue streams.

- Gross Margin:

- Definition: Calculates the percentage of revenue retained by the company after deducting the cost of goods sold (COGS).

- Performance Insights: Monitoring gross margin helps VCs assess the company's profitability and operational efficiency. A high gross margin indicates strong pricing power, cost-effective operations, and the potential for sustainable profitability.

- Churn Rate:

- Definition: Measures the percentage of customers or subscribers who cancel or discontinue their relationship with the company over a specific period.

- Performance Insights: A low churn rate indicates high customer satisfaction, retention, and loyalty. Monitoring churn helps VCs evaluate the quality of the company's products or services, customer support, and overall value proposition.

- Burn Rate:

- Definition: Calculates the rate at which a company consumes its cash reserves to finance operating expenses, including salaries, rent, and marketing.

- Performance Insights: Monitoring burn rate helps VCs assess the company's financial sustainability and runway. A balanced burn rate relative to available funding indicates prudent financial management and the ability to achieve key milestones without running out of capital.

- Lifetime Value (LTV) to Customer Acquisition Cost (CAC) Ratio:

- Definition: Compares the lifetime value of a customer to the cost of acquiring that customer (LTV:CAC ratio).

- Performance Insights: A high LTV:CAC ratio indicates strong return on investment in customer acquisition and the potential for long-term profitability. A ratio of 3:1 or higher is generally considered favorable and indicative of a scalable business model.

- Market Share:

- Definition: Measures the company's share of total market sales or revenue within its target market or industry.

- Performance Insights: Monitoring market share helps VCs assess the company's competitive positioning, market penetration, and growth potential relative to competitors. Increasing market share indicates successful market expansion and customer adoption.

- Runway:

- Definition: Estimates the length of time a company can operate before running out of cash, based on current burn rate and available funding.

- Performance Insights: Monitoring runway helps VCs evaluate the company's financial health, capital needs, and ability to execute its business plan. Sufficient runway allows the company to focus on growth initiatives and achieve key milestones without the risk of imminent cash depletion.

- Net Promoter Score (NPS):

- Definition: Measures customer satisfaction and loyalty based on responses to the question, "How likely are you to recommend our product or service to others?"

- Performance Insights: A high NPS indicates strong customer advocacy, positive word-of-mouth referrals, and potential for organic growth. Monitoring NPS helps VCs assess the company's brand reputation, customer engagement, and market perception.

How Is Artificial Intelligence Used in the Venture Capital Industry?

Artificial Intelligence (AI) is transforming various aspects of the venture capital (VC) industry, revolutionizing how investment decisions are made, deal sourcing is conducted, portfolio companies are managed, and performance is measured. Here are several ways in which AI is used in the venture capital industry:

- Deal Sourcing and Screening:

- Natural Language Processing (NLP): AI-powered algorithms analyze vast amounts of unstructured data from sources such as news articles, social media, company websites, and industry reports to identify potential investment opportunities. NLP enables VC firms to filter through large datasets and uncover relevant information about startups, emerging trends, and market dynamics.

- Data Mining and Analysis: AI algorithms mine data from diverse sources, including startup databases, investment platforms, and public records, to identify promising startups based on predefined criteria such as industry sector, geographic location, funding stage, and growth potential. Data analysis tools provide insights into market trends, competitive landscapes, and investment opportunities, enabling VC firms to make informed decisions.

- Due Diligence:

- Predictive Analytics: AI-driven predictive modeling techniques analyze historical data, financial metrics, market trends, and performance indicators to assess the viability and potential success of startup investments. Predictive analytics help VC firms evaluate factors such as market demand, competitive positioning, revenue projections, and risk factors, facilitating more accurate due diligence and investment decision-making.

- Sentiment Analysis: AI algorithms analyze sentiment and opinion data from social media, news articles, and online forums to gauge market sentiment, investor sentiment, and public perception of startup companies. Sentiment analysis helps VC firms assess market sentiment towards potential investments, identify emerging trends, and anticipate shifts in investor sentiment.

- Portfolio Management:

- Predictive Analytics and Risk Management: AI-powered analytics platforms analyze portfolio company data, financial metrics, market trends, and external factors to identify potential risks, opportunities, and growth drivers. Predictive analytics help VC firms anticipate market changes, assess portfolio company performance, and optimize investment strategies to maximize returns and minimize risks.

- Performance Monitoring and Reporting: AI-driven dashboards and reporting tools provide real-time insights into portfolio company performance, financial metrics, key performance indicators (KPIs), and investment returns. Automated reporting systems streamline portfolio monitoring, enable data-driven decision-making, and facilitate communication between VC firms and portfolio companies.

- Market Analysis and Trend Forecasting:

- Machine Learning Algorithms: AI-powered machine learning algorithms analyze large datasets to identify market trends, consumer behavior patterns, and investment opportunities. Machine learning models can predict future market trends, identify emerging industries, and guide investment strategies based on historical data and predictive analytics.

- Natural Language Processing (NLP): AI-driven NLP algorithms analyze textual data from news articles, research reports, and industry publications to extract insights, identify market trends, and assess industry dynamics. NLP enables VC firms to stay informed about market developments, identify investment opportunities, and make data-driven decisions based on qualitative and quantitative analysis.

- Investor Relations and Communication:

- Chatbots and Virtual Assistants: AI-powered chatbots and virtual assistants provide personalized support and assistance to investors, entrepreneurs, and stakeholders. Chatbots can answer common questions, provide information about investment opportunities, and facilitate communication between VC firms and external parties, enhancing investor relations and engagement.

- Natural Language Processing (NLP): AI-driven NLP algorithms analyze communication data, emails, and documents to extract insights, identify trends, and assess sentiment. NLP enables VC firms to understand investor sentiment, address concerns, and tailor communication strategies to meet the needs and preferences of investors and stakeholders.