Financial Business Intelligence Software

Integrating financial data, while still considering volume, security, and time, is an understandably complex task. InetSoft has a track record of proven success serving financial institutions and solution providers. InetSoft's full range of enterprise reporting and business intelligence features provide a powerful set of tools for the financial sector.

In contrast to other business intelligence providers that only offer reporting or dashboards, InetSoft's business intelligence system is complete. It includes tools for analytics, as well as for sophisticated dashboard and reporting capabilities. InetSoft also does not require an intermediate data access layer, and instead offers ways to connect to almost any data source.

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

Portfolio Performance Management

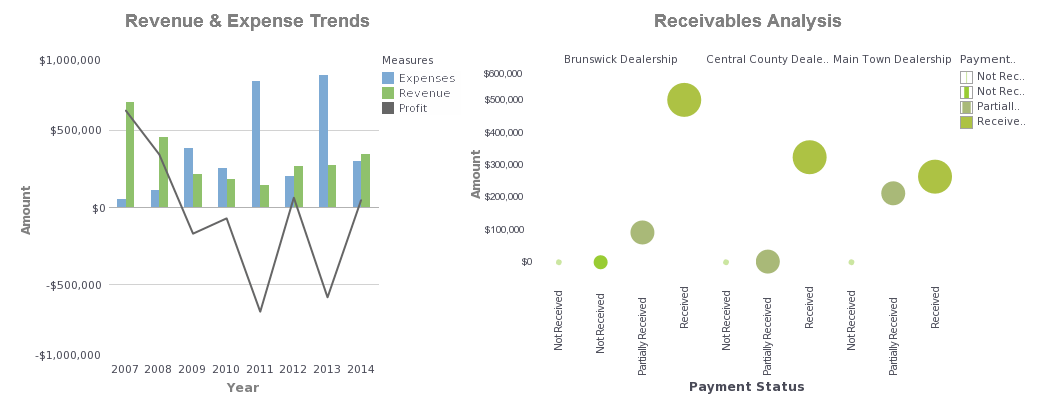

Asset management is a rapidly expanding area of importance for banking institutions. Maintaining a complex security instruments file, providing numerous, accurate client reports, and supporting real-time information access, quickly becomes an intimidating task. However with InetSoft's powerful visualization engine, report bursting, and ad hoc reporting tools, this process can easily become much more manageable. Each business function can be broken down and delegated to automated tasks, client self-service tasks, and professional driven tasks for more efficient handling.

Asset allocation strategies are adjusted frequently, to keep up with consistently altering market conditions. Identifying risk levels and creating efficient asset distribution for a large number of clients can place extreme demands on limited company resources. InetSoft's sophisticated visualization dashboards, when directly linked to a transactional database, drastically reduce the complexity of this business process.

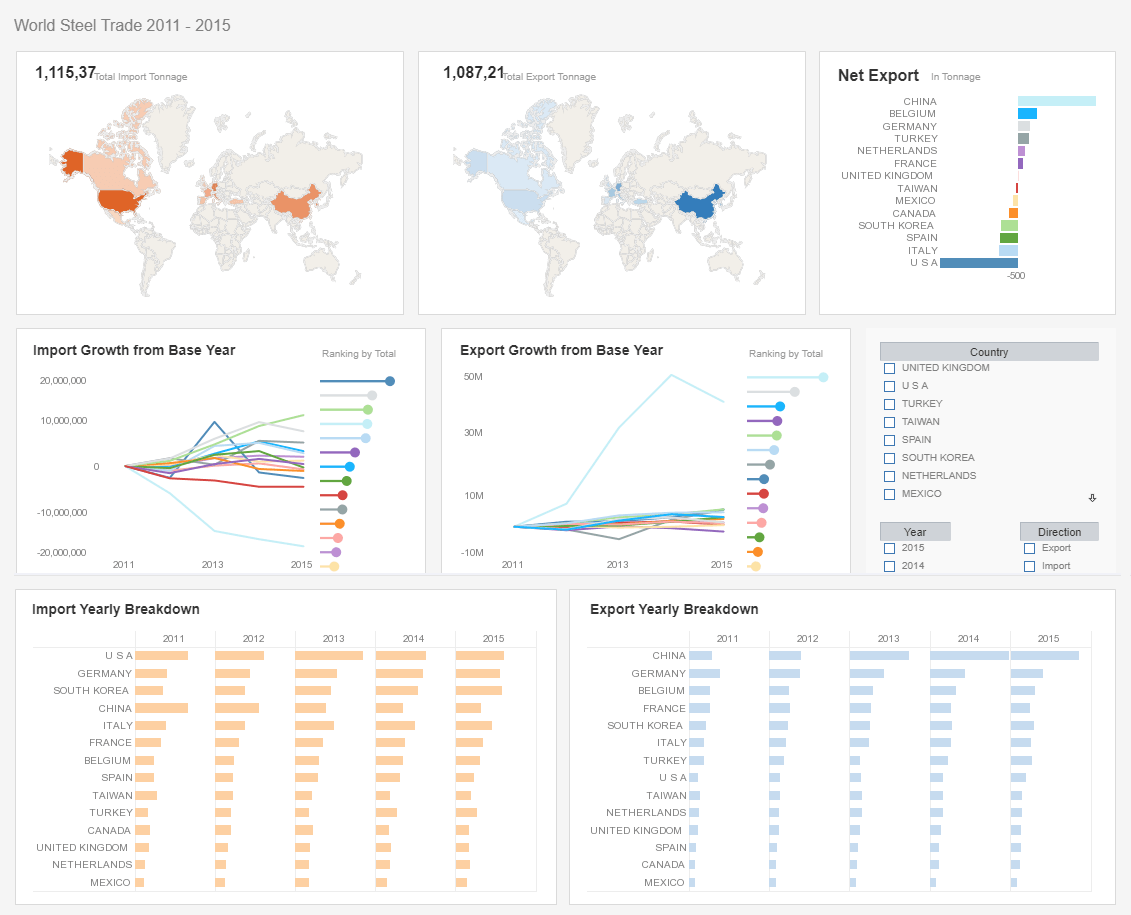

|

View live interactive examples in InetSoft's dashboard and visualization gallery. |

Financial KPIs, Metrics, and Ratios

Gross Profit Margin - an indicator of profitability that details how much one makes on each dollar of sales before expenses are considered; most important to executives and managers: (Revenue – Cost of goods sold) / Revenue

Current Ratio - provides an assessment of an organization's ability to pay all debts over a certain length of time; most important to executives, banks, and lenders: Current Assets / Current Liabilities

Inventory Turnover - shows how often a company's inventory is sold and replaced in a period; most important to: managers and executives: (Total Sales - Cost of Sales) / (Inventory remaining at end of year)

Return on Equity - measures a company's profitability by calculating how much profit a company generates from the money that shareholders have invested; most important to executives and managers: Net Income (After Taxes) / Average Shareholder Equity

How Is AI Used in Corporate Finance Departments?

AI is increasingly transforming corporate finance departments by automating routine tasks, enhancing decision-making processes, and providing deep insights through data analysis. Here's a detailed look at how AI is being utilized in various aspects of corporate finance:

1. Automating Routine Processes

Accounts Payable and Receivable: AI-powered systems can automate invoice processing, matching purchase orders with invoices, and flagging discrepancies. This reduces manual effort, speeds up processing times, and minimizes errors.

Expense Management: AI tools can automate expense report submissions and approvals. By scanning receipts and matching them with transactions, AI reduces the burden on employees and finance teams.

Payroll Processing: AI streamlines payroll by automating calculations, ensuring compliance with tax laws, and managing employee benefits. This ensures accuracy and timely payments.

2. Enhancing Financial Analysis and Forecasting

Predictive Analytics: AI algorithms analyze historical data to predict future financial trends. This helps in forecasting revenue, expenses, and cash flow, enabling better budgeting and strategic planning.

Risk Management: AI identifies patterns and anomalies that could indicate potential risks, such as fraud or financial irregularities. By continuously monitoring transactions, AI systems can flag suspicious activities in real-time.

Investment Analysis: AI-driven tools can analyze market trends, financial statements, and other data to provide insights into investment opportunities. This supports better decision-making regarding mergers, acquisitions, and portfolio management.

3. Improving Decision-Making

Real-time Reporting: AI enables real-time financial reporting, providing up-to-date information on the company's financial health. This allows CFOs and other executives to make informed decisions quickly.

Scenario Analysis: AI can simulate various business scenarios, helping finance teams understand potential outcomes of different strategies. This aids in planning and risk assessment.

Benchmarking and Performance Metrics: AI tools help in benchmarking a company's performance against industry standards. This provides insights into areas needing improvement and helps in setting realistic performance targets.

4. Enhancing Compliance and Regulatory Reporting

Regulatory Compliance: AI ensures that financial processes comply with regulatory requirements by automating compliance checks and reporting. This reduces the risk of non-compliance and the associated penalties.

Audit and Internal Controls: AI assists in internal audits by analyzing large volumes of transaction data to detect anomalies. This enhances the effectiveness of internal controls and improves audit accuracy.

5. Customer and Supplier Interactions

Customer Service: AI chatbots and virtual assistants handle customer inquiries related to billing, payments, and account management. This improves customer satisfaction and frees up human resources for more complex tasks.

Supplier Management: AI can analyze supplier performance, manage contracts, and optimize procurement processes. This ensures better supplier relationships and cost efficiency.

6. Data Management and Security

Data Integration and Management: AI helps in integrating data from various sources, ensuring consistency and accuracy. This provides a single source of truth for financial data, facilitating better analysis and reporting.

Cybersecurity: AI enhances cybersecurity by monitoring financial systems for potential threats. It can detect and respond to suspicious activities, protecting sensitive financial data from breaches.

Challenges and Considerations

While AI offers numerous benefits, its implementation in corporate finance also comes with challenges:

Data Quality: AI systems rely on high-quality data. Ensuring the accuracy and completeness of data is crucial for effective AI deployment.

Integration with Existing Systems: Integrating AI with legacy systems can be complex and may require significant investment in technology and training.

Change Management: Adopting AI requires a cultural shift within the organization. Employees need to be trained to work alongside AI systems, and there may be resistance to change.

Ethical and Privacy Concerns: The use of AI raises ethical questions, particularly around data privacy. Companies must ensure that AI systems comply with privacy regulations and ethical standards.

Read what InetSoft customers and partners have said about their selection of Style Scope for their solution for dashboard reporting. |

More Articles About Financial BI

Finance Data Consolidation and Mashup - The finance department interacts with many areas. Consolidating data from various systems and departments can be a very challenging task. This often is the source of spreadsheet hell that breaks data lineage and causes inconsistent reporting. InetSoft's data mashup technology is an elegant solution...

Forex Trader's Dashboards - A Forex trader's dashboard typically incorporates key performance indicators (KPIs) and analytics to provide a comprehensive view of market conditions, trading performance, and risk management. Here are some common KPIs and analytics used on a Forex trader's dashboard: Account Balance and Equity: Current Balance: The total amount of funds in the trading account. Equity: The account balance plus or minus any floating profits or losses. Profit and Loss (P&L) Metrics: Net Profit/Loss: The total profit or loss from all closed trades. Daily/Weekly/Monthly P&L: Breakdown of profits or losses over specific timeframes...

Transformation of Finance BI - I believe we're really seeing a transformation of Finance. They are moving towards being that strategic advisor for the business. But one of the big challenges for CFOs and for finance departments is they're really trying to balance that with being a cost center. There's always a push for greater efficiency and cost containment. So at one level, they're trying to drive cost out of the business and do things as efficiently as possible. At the same time Finance is being asked, and the organization wants them to become much more of a strategist and strategic advisor to the business...

Treatment Effectiveness KPI - Treatment efficacy is another key KPI for mental health treatments. How successfully mental health services accomplish their therapeutic objectives is measured by treatment effectiveness. To evaluate the efficiency of their treatment programs and make necessary modifications, mental health services must measure treatment effectiveness...