Loan Management Analytics

In the ever-evolving landscape of loan management, understanding key factors that influence the tendency to default is vital for financial institutions. By monitoring loan segmentation, purpose analysis, and borrower characteristics, lenders can make informed decisions about loan origination and management.

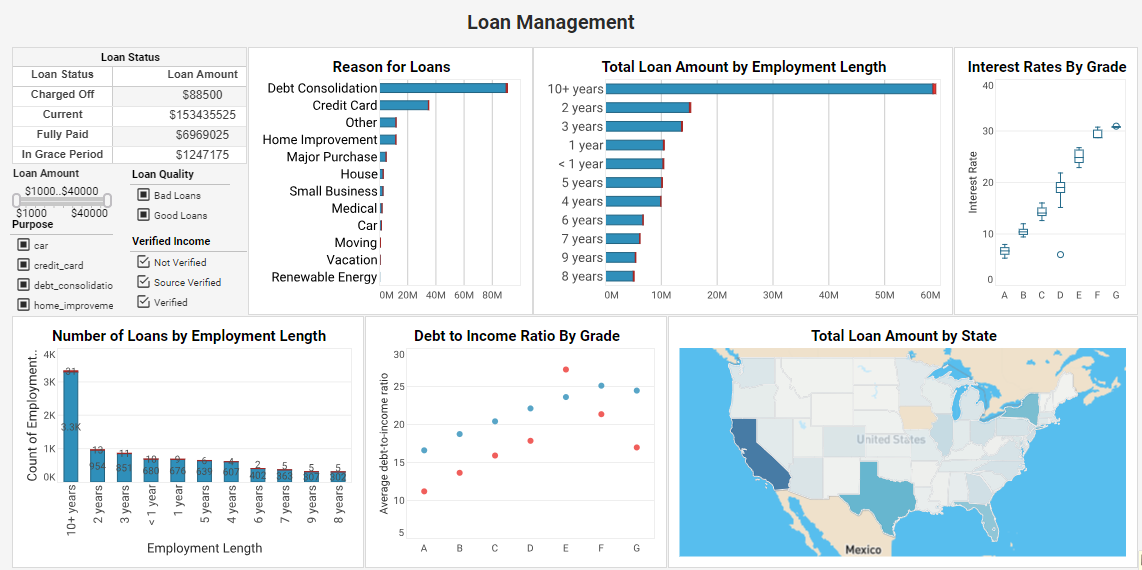

In response to these industry demands, InetSoft presents the Loan Analytics Dashboard, an indispensable solution that delves deep into loan attributes and borrower characteristics. By analyzing factors such as loan purpose, grade, employment length, debt-to-income ratio, and more, this dashboard equips lenders with data-driven insights that optimize loan strategies and ensure a seamless lending process.

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |

Loan Dashboard

Visualize Relationships: Our Loan Dashboard empowers lenders to effortlessly visualize the intricate relationships between various factors and loan statuses. By providing an intuitive interface, lenders can grasp essential insights at a glance.

Interactive Data Exploration: Through the power of interactive charts and sliders, lenders can proactively monitor loan trends, fine-tune strategies, and adapt to dynamic market conditions.

Key Benefits of the Loan Dashboard

- Data-Driven Decision Making: The Loan Dashboard empowers lenders with decisions grounded in data-driven insights. This dramatically reduces the risk of overlooking critical trends or correlations vital for successful loan approvals and minimizing defaults.

- Targeted Risk Management: By gaining a deep understanding of loan segments that carry higher risks, lenders can strategically implement targeted risk management strategies. This results in a high quality loans, reduced default rates, and greater profitability.

- Enhanced Loan Origination Strategies: With insights from Purpose Analysis, lenders can expertly refine loan offerings, optimizing loan origination strategies to meet specific borrower needs and preferences.

- Streamlined Operations: The Loan Dashboard's intuitive and user-friendly interface streamlines loan management operations. Loan officers and managers can navigate seamlessly, accessing critical information with ease.

|

View the gallery of examples of dashboards and visualizations. |

The Loan Dashboard is built on InetSoft"s advanced technology, delivering unmatched data intelligence and reporting solutions. From its user-friendly design to its scalable architecture, it's the perfect ally for lenders of all sizes.

The Loan Dashboard encapsulates InetSoft's ingenious approach by integrating data mashup and visualization design within a single web application. This innovative approach streamlines collaboration between design professionals and business stakeholders, enabling swift and effective development.

InetSoft's commitment to flexible charts, tables, and rich visual components ensures that our Loan Dashboard is equipped with a wide array of visualization tools, enabling lenders to comprehend loan data effortlessly.

Loan Management Analysis with InetSoft StyleBI

InetSoft's StyleBI provides clients with a user-friendly interface that integrates a library of useful tools for creating, managing, or analyzing loans.

With InetSoft's powerful business intelligence solution, you can:

- Mash up data from almost any data source

- Quickly profile data and verify data manipulations via data visualization

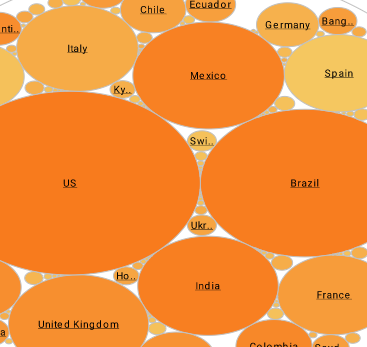

- Create pie charts, scatter plots, interactive maps, and more with just a few clicks

- Cater any dashboard solution to your specific needs with easy-to-use drag-and-drop design tools

- Visually analyze machine learning results to find hidden patterns with InetSoft's built-in machine learning capability

- Access your dashboard from mobile devices such as smartphones and tablets

The use of the InetSoft's solution would help unlock the full potential of the loan analysts, helping them make better lending decisions and quicker in extracting actionable insights from abundant amounts of data.

Learn how InetSoft supercharges BI with Spark to make machine learning easy. |

More KPIs to Track on a Loan Underwriting Dashboard

A loan underwriting dashboard tracks a variety of key performance indicators (KPIs) and metrics to assess the efficiency and effectiveness of the loan underwriting process. These KPIs provide insights into the performance of underwriters, the quality of the loan portfolio, and the overall health of the underwriting operations. Here are some essential KPIs and their definitions along with their significance in performance management:

1. Approval Rate

Definition: The percentage of loan applications that are approved out of the total number of applications received. Significance: A higher approval rate can indicate a more efficient underwriting process or a lower risk threshold, while a lower rate might suggest stricter criteria or issues in the applicant pool. This KPI helps in understanding the quality and risk level of applicants.

2. Average Processing Time

Definition: The average time taken to process a loan application from submission to decision (approval or denial). Significance: This metric is critical for assessing the efficiency of the underwriting process. Faster processing times can enhance customer satisfaction and operational efficiency, whereas longer times might indicate bottlenecks or inefficiencies in the workflow.

3. Loan Default Rate

Definition: The percentage of loans that default (i.e., borrowers fail to meet their payment obligations) out of the total number of approved loans. Significance: This KPI is crucial for risk management. A high default rate suggests potential issues in the underwriting criteria or the economic environment, necessitating adjustments to mitigate risk.

4. Debt-to-Income (DTI) Ratio

Definition: The average ratio of a borrower's total monthly debt payments to their gross monthly income. Significance: The DTI ratio helps in assessing the creditworthiness of borrowers. A lower DTI ratio typically indicates better financial stability of the borrowers, reducing the risk of default.

5. Conversion Rate

Definition: The percentage of pre-approved loan offers that are accepted by the borrowers. Significance: This metric indicates the attractiveness and competitiveness of the loan products offered. A higher conversion rate suggests that the loan terms are appealing to borrowers, while a lower rate might indicate the need for better terms or marketing strategies.

6. Portfolio Yield

Definition: The average interest rate earned on the loan portfolio. Significance: This KPI measures the profitability of the loans underwritten. A higher yield indicates better returns on the loan portfolio, which is crucial for the financial health of the lending institution.

7. Underwriting Accuracy Rate

Definition: The percentage of loans that perform as expected (i.e., loans that do not default or become delinquent) out of the total number of underwritten loans. Significance: This metric assesses the precision of the underwriting process. High accuracy indicates that the underwriting criteria and risk assessments are effective, whereas low accuracy might necessitate a review and adjustment of the underwriting guidelines.

8. Cost per Underwritten Loan

Definition: The total cost incurred in the underwriting process divided by the number of loans underwritten. Significance: This KPI helps in understanding the operational efficiency and cost-effectiveness of the underwriting process. Lower costs per loan indicate more efficient use of resources.

9. Loan Approval to Funding Time

Definition: The average time taken from loan approval to the disbursement of funds to the borrower. Significance: This metric is important for customer satisfaction and operational efficiency. Shorter times from approval to funding enhance the borrower experience and indicate streamlined processes.

10. Loan Application Volume

Definition: The total number of loan applications received within a specific period. Significance: Tracking application volume helps in understanding market demand and the effectiveness of marketing efforts. It also aids in resource planning and management.

11. Loan Quality Index

Definition: A composite score that evaluates the overall quality of the loans based on factors such as borrower credit score, DTI ratio, loan-to-value ratio, etc. Significance: This index provides a holistic view of the quality and risk profile of the loan portfolio, guiding strategic decision-making and risk management.

More Articles About Fintech Dashboards

Challenge of Analytic Talent Management - Technology in its own right won't be the single solution. The second part is the challenge of talent management. People will invariably need to change, change the way they work, change the way they develop simply because of the impact of the technology. That takes us into areas of training and enablement...

Data Mapping for Underwriting - NBFCs and financial institutions deploy their well-honed procedures for lending money to borrowers. To ensure a clear audit trail of required documents, these organizations use third-party tools and processes before disbursement - all in the name of stringent documentation needs. Data mapping enables companies to make a unified compilation of all their structured and unstructured data for detailed analysis. This assembly can include everything from internal application information, third-party integrations, and credit scores to even in-depth borrower details - giving businesses the insights they need with just one glance...

Replacement for Qlik Sense Business Intelligence - Looking for a good alternative to the Qlik Sense business intelligence tool? InetSoft's pioneering dashboard reporting application makes producing great-looking web-based reports and dashboards easy with a drag-and-drop designer and the ability to connect to all your data sources. Maximize self-service for business and technical staff. View a demo and try interactive examples. Read the comparison of InetSoft to Qlik based on G2 user feedback...

Streamline Internal Reporting for Credit Unions - A data visualization dashboard is perfect for this task because of the existing reporting systems that need an upgrade (in fact, 77 percent of decision-makers in the banking industry say reporting is a challenge for their organizations). For example, many credit unions typically segment their operations by products and services like credit cards, loans, and retirement accounts. This approach significantly hinders data sharing across the organization...