Why Does Your Organization Need Mobile Reporting Tools?

There's no question that the evolution of mobile technology in recent years has been a major game-changer in both our private and professional lives. Nowadays, it seems like everyone has their own smartphone or tablet, so a reporting solution that is compatible with these devices is a natural fit.

Such a solution can empower your employees and accelerate the growth of your business. StyleBI, by InetSoft, is that solution.

Evaluate InetSoft for Your Mobile Reporting Solution

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Stay Ahead of the Curve | Accessible Mobile BI

Give your users access to the data they need, regardless of where they are.

Organizations that frequently monitor key performance indicators and quickly respond to changes in the market will always outperform their slower, less informed competition. And if you find that users need to access information at all times, be it at the office, in a meeting, or at home, you need to be looking into mobile reporting tools.

Empower Your Employees | Robust Mobile Reporting

Flexible mobile reporting allows users in the field to gain insights and make better decisions.

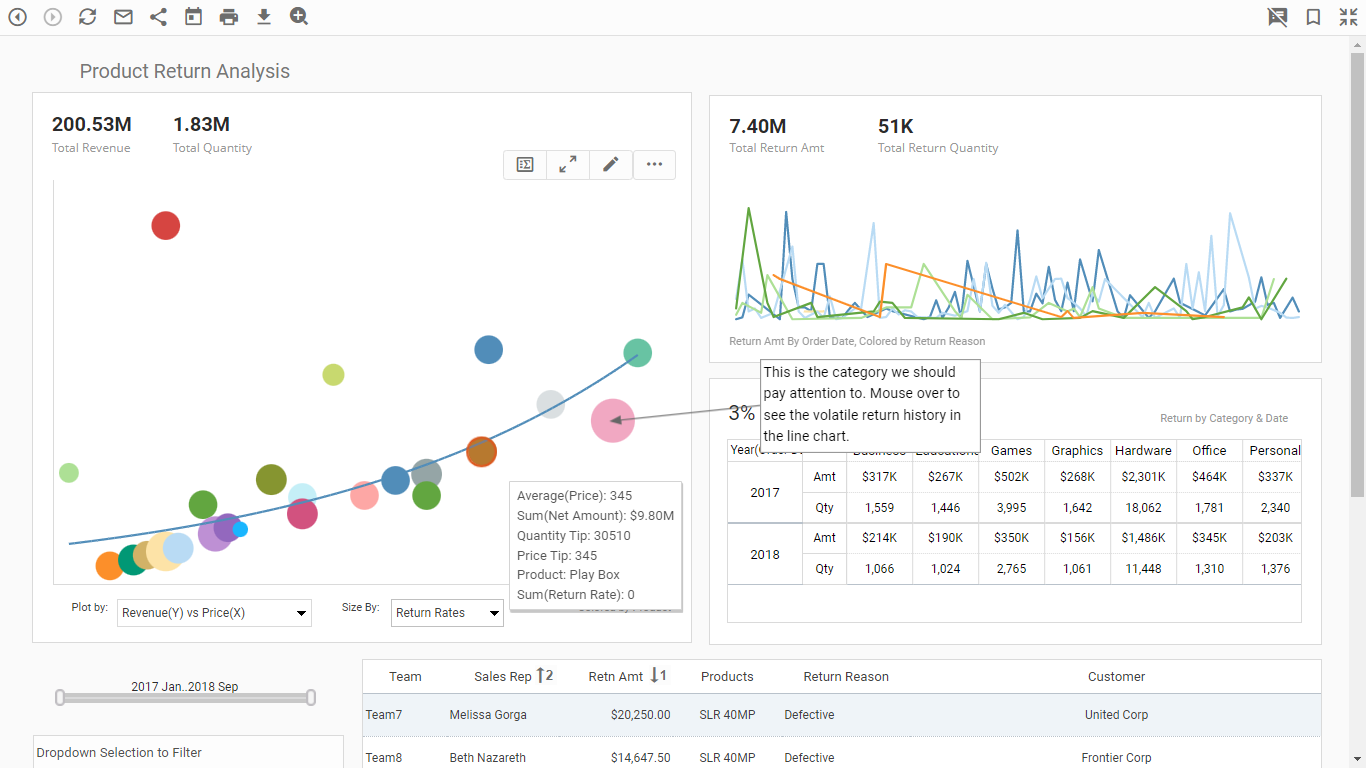

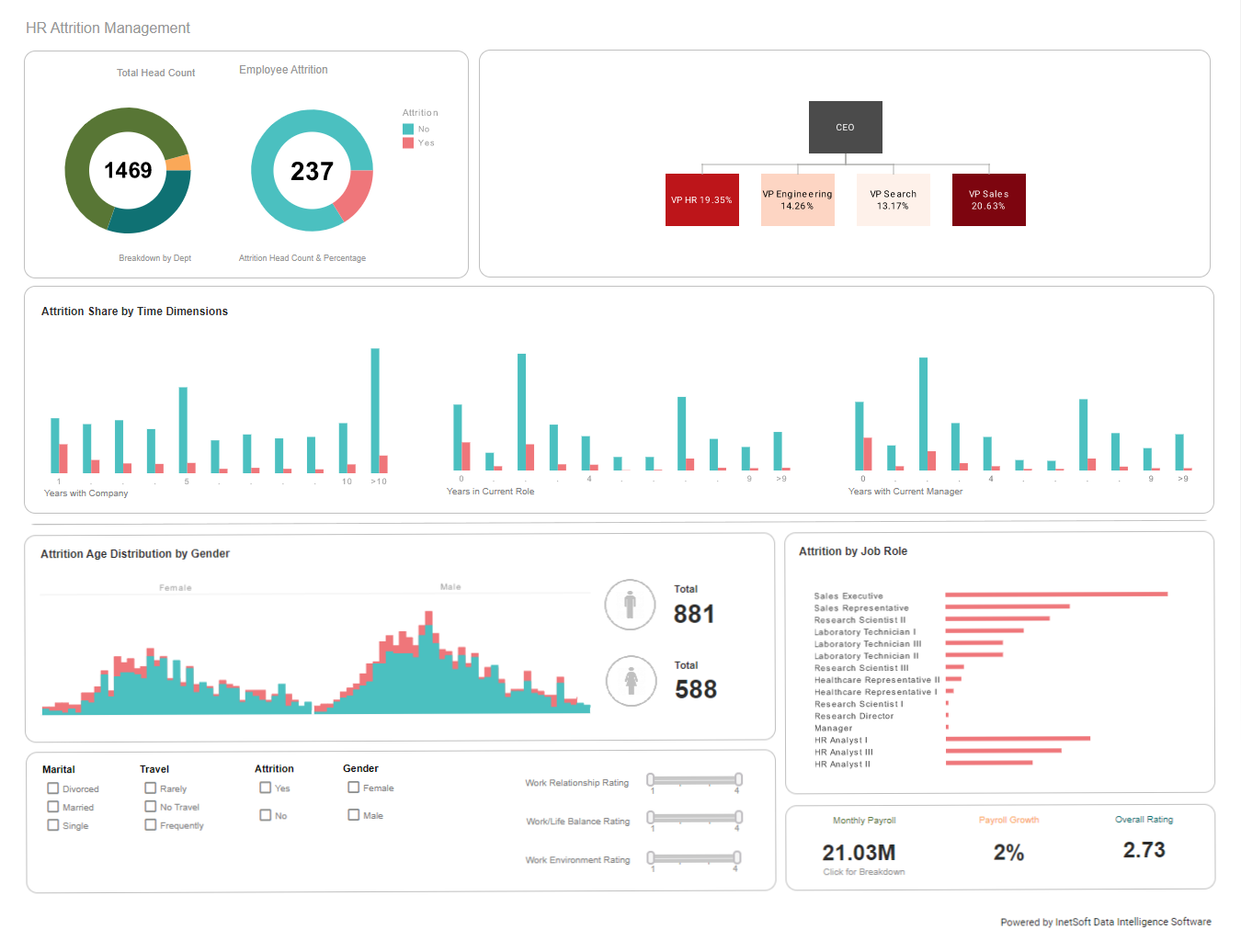

Mobile reporting should consist of more than just text messages and alerts sent to your user's phones. InetSoft's robust mobile reporting tools give users the ability to view sophisticated visualizations and interact with data in real time, empowering the user to make sound decisions. As opposed to being given a limited version of report drill down capabilities, InetSoft users are afforded the freedom to actually ask questions while in the field.

Access Multiple Data Sources | A Single Source of Information

A single solution that fits the needs of all users.

With StyleBI, you won't have to make a choice between on-premise BI or a mobile solution. InetSoft offers a Web-based solution that is also compatible with mobile devices such as the iPad, iPhone, and all manner of Android devices.

With the power of InetSoft's user-friendly data mashup capabilities, users can create dashboards and reports that combine many disparate sources of data. Ultimately, StyleBI is a single solution that fits the needs of business users and IT professionals alike.

About InetSoft

Since 1996 InetSoft has been delivering easy, agile, and robust business intelligence software that makes it possible for organizations and solution providers of all sizes to deploy or embed full-featured business intelligence solutions. Application highlights include visually-compelling and interactive dashboards that ensure greater end-user adoption plus pixel-perfect report generation, scheduling, and bursting.

InetSoft's patent pending Data Block™ technology enables productive reuse of queries and a unique capability for end-user defined data mashup. This capability combined with efficient information access enabled by InetSoft's visual analysis technologies allows maximum self-service that benefits the average business user, the IT administrator, and the developer. InetSoft solutions have been deployed at over 5,000 organizations worldwide, including 25% of Fortune 500 companies, spanning all types of industries.

What KPIs and Metrics Are Tracked in Debt Collection Dashboards?

In the debt collection industry, performance management is essential for optimizing efficiency, ensuring compliance, and improving overall financial health. Debt collection dashboards serve as a vital tool for monitoring and analyzing key performance indicators (KPIs) and metrics. These dashboards provide real-time insights that help managers make informed decisions and implement strategies to enhance the effectiveness of their operations. Here, we will discuss various KPIs and metrics commonly tracked in debt collection dashboards, their definitions, and their significance in performance management.

1. Total Amount Collected

Definition: The total amount of money collected from debtors over a specific period.

Significance: This is a fundamental metric that indicates the overall success of the debt collection efforts. It helps organizations assess their revenue performance and set future targets.

2. Collection Rate

Definition: The percentage of the total debt that has been successfully collected. It is calculated by dividing the amount collected by the total amount of debt and multiplying by 100.

Significance: The collection rate provides a clear picture of the effectiveness of the collection strategies. A higher collection rate indicates better performance.

3. Recovery Rate

Definition: Similar to the collection rate but typically used to refer specifically to the recovery of written-off or delinquent debts.

Significance: This metric is crucial for understanding how well the organization recovers from potential losses due to bad debts.

4. Average Days Delinquent (ADD)

Definition: The average number of days that debts remain unpaid past their due date.

Significance: ADD helps in evaluating the efficiency of the collection process. A lower ADD indicates that debts are being collected more quickly.

5. Promise to Pay Rate

Definition: The ratio of the number of promises to pay made by debtors to the total number of debtor contacts.

Significance: This metric helps assess the likelihood of future payments and the effectiveness of communication strategies with debtors.

6. Right Party Contact (RPC) Rate

Definition: The percentage of successful contacts made with the correct debtor.

Significance: A high RPC rate signifies effective debtor tracing and contact strategies, which are critical for successful collections.

7. Agent Utilization Rate

Definition: The percentage of time that collection agents spend on productive collection activities.

Significance: This KPI is important for resource management. Higher agent utilization rates indicate efficient use of human resources.

8. Call-to-Payment Ratio

Definition: The ratio of the number of calls made to debtors to the number of payments received.

Significance: This metric evaluates the effectiveness of phone call strategies. A lower ratio suggests that fewer calls are needed to secure payments, indicating efficient call management.

9. Average Payment Size

Definition: The average amount of money received per payment transaction.

Significance: This KPI helps in understanding debtor payment behavior and adjusting collection strategies accordingly. Larger average payments may indicate successful negotiation for higher repayment amounts.

10. First Call Resolution (FCR) Rate

Definition: The percentage of debt issues resolved on the first contact with the debtor.

Significance: High FCR rates indicate effective communication and problem-solving by collection agents, reducing the need for follow-up calls and improving overall efficiency.

11. Dispute Rate

Definition: The percentage of debts disputed by debtors.

Significance: Monitoring the dispute rate helps in identifying potential issues in the debt collection process or inaccuracies in debt information. A lower dispute rate suggests smoother operations and higher accuracy.

12. Compliance Rate

Definition: The percentage of collection activities that comply with regulatory and legal standards.

Significance: Ensuring high compliance rates is crucial for avoiding legal issues and maintaining the organization's reputation. This KPI highlights adherence to industry regulations and internal policies.

13. Cost per Collection

Definition: The total cost incurred in the debt collection process divided by the total amount collected.

Significance: This metric helps in evaluating the cost-efficiency of the collection process. Lower costs per collection indicate more efficient use of resources and higher profitability.

14. Debtor Segmentation Analysis

Definition: Analyzing debtor characteristics such as demographics, payment history, and debt size to segment them into different categories.

Significance: This analysis helps tailor collection strategies to different debtor segments, enhancing the effectiveness of collection efforts and improving recovery rates.

15. Skip Tracing Success Rate

Definition: The percentage of successfully located debtors who were initially uncontactable.

Significance: High skip tracing success rates indicate effective techniques for finding debtors who are difficult to locate, thereby improving overall collection rates.

16. Debt-to-Income (DTI) Ratio

Definition: The ratio of a debtor's total debt to their total income.

Significance: Understanding the DTI ratio helps assess the debtor's ability to repay their debt, allowing for better risk management and more informed decision-making regarding payment plans.

Read what InetSoft customers and partners have said about their selection of Style Scope for their solution for dashboard reporting. |

How Is Artificial Intelligence Used in Debt Collection?

Here's a detailed look at how AI is being utilized in the debt collection process:

1. Predictive Analytics

Application: AI uses predictive analytics to assess the likelihood of successful debt recovery. By analyzing historical data, AI models can predict which accounts are more likely to pay and which are at risk of default.

Benefits: This helps agencies prioritize their efforts, focusing on high-probability accounts to maximize recovery rates while allocating fewer resources to less promising cases.

2. Automated Communications

Application: AI-powered chatbots and virtual assistants handle routine communications with debtors. These systems can send reminders, answer common questions, and even negotiate payment plans without human intervention.

Benefits: This automation reduces the workload on human agents, allowing them to focus on more complex cases. It also ensures 24/7 availability, improving debtor engagement and responsiveness.

3. Sentiment Analysis

Application: AI tools analyze the tone and sentiment of debtor communications to gauge their emotional state and likelihood of payment. This analysis helps in customizing responses to address debtor concerns more empathetically.

Benefits: Understanding debtor sentiment improves the quality of interactions, leading to higher satisfaction and cooperation from debtors. It also helps in identifying when to escalate issues to human agents.

4. Fraud Detection

Application: AI algorithms detect fraudulent activities by analyzing patterns and anomalies in debt repayment behaviors. These systems flag suspicious accounts for further investigation.

Benefits: Early detection of fraud reduces financial losses and helps maintain the integrity of the debt collection process. It also enhances security and trust in the agency's operations.

5. Natural Language Processing (NLP)

Application: NLP allows AI to understand and process human language, enabling chatbots and virtual assistants to interact with debtors naturally. It also helps in analyzing large volumes of unstructured data, such as emails and social media interactions.

Benefits: Improved communication through NLP leads to more effective and efficient resolution of debtor queries. It also enables better analysis of debtor feedback for continuous improvement in collection strategies.

6. Personalized Payment Plans

Application: AI analyzes debtor financial data to create personalized payment plans that align with their ability to pay. This customization includes recommending payment amounts, frequencies, and deadlines.

Benefits: Personalized payment plans increase the likelihood of debtor compliance and successful recovery. They also reduce the strain on debtors, fostering a more cooperative relationship.

7. Automated Document Processing

Application: AI automates the processing of documents related to debt collection, such as invoices, payment receipts, and legal notices. Optical Character Recognition (OCR) and machine learning are key technologies used here.

Benefits: Automation speeds up document handling, reduces errors, and ensures that critical information is captured accurately. This efficiency leads to faster resolution of debt cases.

8. Debt Segmentation

Application: AI segments debtors into different categories based on factors such as payment history, debt amount, and financial behavior. This segmentation allows for more targeted collection strategies.

Benefits: Tailored approaches for different debtor segments improve the effectiveness of collection efforts. Agencies can apply specific tactics that are more likely to succeed with each segment.

9. Collection Strategy Optimization

Application: AI continuously analyzes the effectiveness of various collection strategies and suggests optimizations. This involves testing different approaches and learning from outcomes to refine tactics.

Benefits: Optimizing collection strategies through AI leads to higher recovery rates and more efficient use of resources. It also enables dynamic adjustments to changing debtor behaviors and market conditions.

10. Compliance Monitoring

Application: AI systems monitor collection activities to ensure compliance with legal and regulatory requirements. They can automatically flag potential violations and generate compliance reports.

Benefits: Maintaining compliance is critical to avoid legal penalties and reputational damage. AI helps ensure that all actions adhere to relevant laws, reducing the risk of non-compliance.

11. Agent Performance Analysis

Application: AI evaluates the performance of collection agents by analyzing metrics such as call duration, resolution rates, and debtor feedback. It provides insights into areas where agents can improve.

Benefits: Performance analysis helps in training and development, leading to more skilled and effective agents. It also aids in identifying and rewarding top performers.

12. Resource Allocation

Application: AI helps in optimizing resource allocation by predicting the necessary manpower and tools required for different collection tasks. It ensures that resources are used efficiently across various operations.

Benefits: Efficient resource allocation reduces operational costs and improves overall productivity. It ensures that high-priority tasks receive the attention they need.

13. Multichannel Engagement

Application: AI facilitates multichannel engagement, enabling communication with debtors through various platforms such as phone, email, SMS, and social media. It tracks interactions across these channels to provide a cohesive experience.

Benefits: Multichannel engagement meets debtors where they are most comfortable, improving response rates and satisfaction. It also provides a holistic view of debtor interactions for better strategy formulation.

14. Predictive Dialing

Application: AI-powered predictive dialers automate the calling process, ensuring that agents are connected to live debtors as efficiently as possible. The system predicts when agents will be free and places calls accordingly.

Benefits: Predictive dialing increases agent productivity and reduces idle time. It also improves the chances of successful contact with debtors.

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |

More Articles About Mobile Reporting

Benefits of Data Mashup Solutions - Data mashup is an increasingly important tool for businesses of all sizes, allowing users to gain new insights and spot trends within data. But what exactly is data mashup, and what makes it so valuable? The term "mashup" emerged in the media-sphere within the past decade as people seized on the opportunities that new software and hardware technologies provided in combining different media together. However, in recent years...

Categories of ETL Monitoring - We've grouped those into three major categories, whether that will affect the accuracy of the data, the conformity of that data, whether it conforms to our business rules or the integrity of that data. Now if I want to then drill down and understand how that trend is going over time, I can click on more when it loads. On the dashboard here, I can see that I have all my different custom rules on the right hand side...

Companies Leverage Business Intelligence - But leading companies around the world, and ones that are really successful, even if their revenues are declining over time, are finding that the use of information, clearly business intelligence information, is assisting them in making better decisions on how to use resources and at the same time reducing costs in processes, changing processes during a volatile time and not just hunkering down financially, but becoming more innovative...

Gaps and Challenges - And then underneath each of these, we have what we refer to as the attributes, where over the years we were smart enough when we worked with companies that did really well in just one of these little areas, we wrote down why they were doing really well. And we use those attributes to really analyze these organizations and to identify where they have some gaps and some challenges. And here is what that may look like at the element level...