FMCG Analytics

FMCG stands for Fast-Moving Consumer Goods. These are products that sell quickly at relatively low cost, often with a high turnover rate. FMCG goods are typically everyday items that consumers buy regularly and in small quantities, as they are either perishable or quickly consumed. FMCGs include foods and beverages, household products, personal care products, and over-the-counter medications.

These products are characterized by frequent purchases, low prices, and quick usage. For this reason, FMCG companies prioritize efficient production, distribution, and marketing to maintain a competitive edge in a sector that depends heavily on brand loyalty and sales volume.

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |

The Need for FMCG Dashboards

The FMCG industry has distinct characteristics that set it apart from other sectors, driven by the rapid turnover and high demand for everyday goods. FMCG products are typically sold at low prices with relatively thin profit margins. The volume of sales compensates for this, making it a highly competitive, high-turnover industry. Many FMCG products are perishable (e.g., food items) or have a limited useful life (e.g., cleaning supplies, toiletries). This makes efficient distribution and quick inventory turnover essential.

FMCG companies often invest heavily in marketing to build strong brand recognition and customer loyalty. Established brands can maintain a competitive advantage and even command premium pricing. FMCG products need to be readily available in large quantities, often through multiple distribution channels like supermarkets, convenience stores, online platforms, and more. The industry relies on extensive distribution networks to reach consumers everywhere.

FMCG Visualization Requirements

Consumers buy FMCG products regularly, sometimes even daily or weekly. This high frequency of purchase is driven by the essential nature of the goods. Because these products are essential, demand remains steady even during economic downturns. Price sensitivity is high, however, with small price changes impacting consumer behavior significantly.

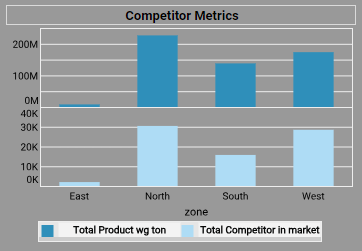

The FMCG industry is highly competitive. With so many players vying for market share, FMCG companies face intense competition, often battling for shelf space and consumer attention. This leads to regular promotions, discounts, and marketing strategies.

FMCG producers keep ahead of their competition by innovating with new products, packaging, or improved versions to meet changing consumer needs and preferences.

|

Read the latest news about InetSoft's user friendly BI software and customer successes. |

The Need for FMCG Analytics

The challenges don't stop with consumer markets, however. FMCG companies must adhere to strict regulations related to product safety, labeling, and quality. This is particularly relevant in food and health products, where quality control is essential.

Analytics enable FMCG companies to make data-informed decisions, adapt to changing consumer demands quickly, and stay competitive in a fast-paced industry. This data-driven approach is crucial for increasing efficiency, improving profitability, and delivering a better customer experience.

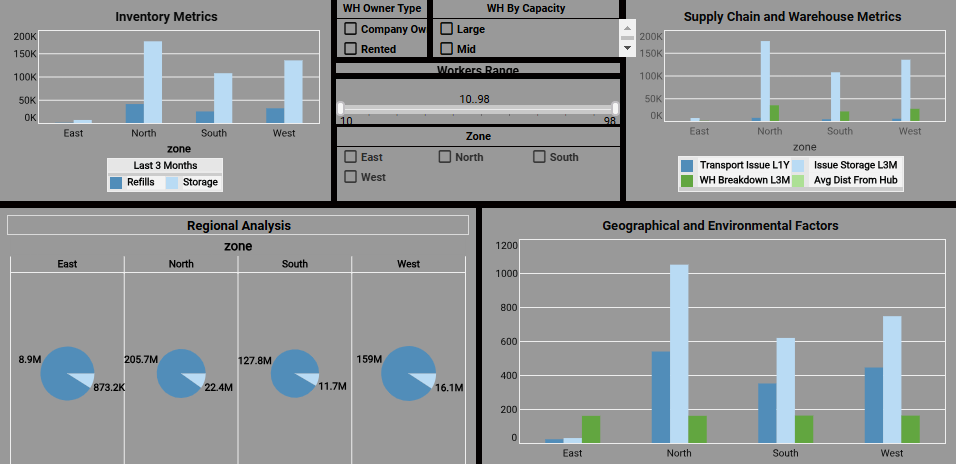

Inventory Management

The dashboard presents a detailed view of inventory levels across various regions and product categories. This information aids in optimizing stock levels, preventing stockouts, and pinpointing slow-moving items.

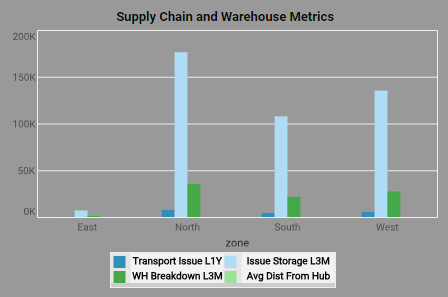

- Supply Chain Performance: Key metrics such as lead times, order fulfillment rates, and warehouse utilization are displayed, helping to identify bottlenecks and areas needing improvement within the supply chain.

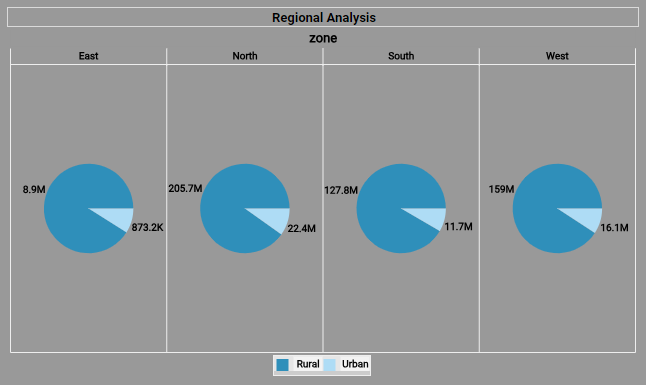

- Regional Analysis: Insights into sales, market share, and customer satisfaction are broken down regionally, allowing businesses to identify high-performing regions and those requiring additional focus.

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |

How to Use the Dashboard in the FMCG Industry

- Strategic Decision Making: Use the insights from the dashboard to inform strategic decisions related to product launches, marketing campaigns, and supply chain enhancements.

- Performance Monitoring: Track key metrics over time to monitor performance, detect trends, and assess the effectiveness of various initiatives.

- Problem Solving: Identify and address issues and bottlenecks in the supply chain promptly through the dashboard's insights.

- Customer Satisfaction: Analyze customer satisfaction data to pinpoint areas for improvement and enhance the overall customer experience.

InetSoft's FMCG Dashboard Overview

The InetSoft dashboard offers a comprehensive view of Fast-Moving Consumer Goods (FMCG) business operations. It provides valuable insights into inventory management, supply chain performance, regional analysis, and more, serving as an essential tool for decision-makers to monitor key metrics, identify trends, and make informed decisions.

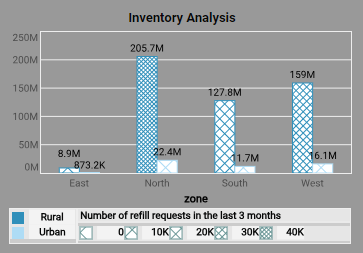

Inventory Analysis

This inventory analysis chart breaks down total inventory by four regions, with each region subdivided by rural and urban areas. A patterned fill adds number of refill requests as an additional dimension, totalling three dimensions in a single chart.

By visualizing inventory levels by region and distinguishing rural from urban areas, FMCG managers can quickly assess where inventory is sufficient and where it might be lacking. This allows for more precise, region-specific inventory management, ensuring that products are available where they're most needed. Including refill requests as a third dimension gives managers guidance in the prioritizing of restocking efforts. Regions with high refill requests indicate higher demand, so the company can allocate resources more effectively and prevent stockouts in those high-need areas.

Rural and urban areas often have distinct purchasing patterns, transportation challenges, and product preferences. This chart enables managers to identify these differences, optimizing product distribution strategies and possibly tailoring product offerings based on the unique needs of each area.

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |

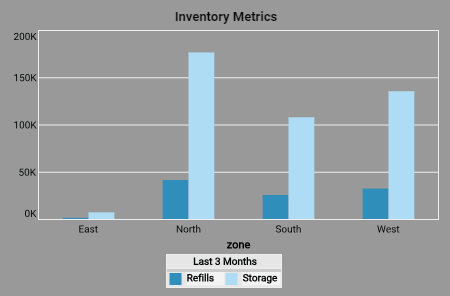

Inventory Metrics

The inventory metrics chart allows for different analysis by displaying how much of each regions inventory is in storage versus how much has been refilled. This aids in logistics optimization, helping optimize inventory flow, reduce storage costs, and ensure timely product availability.

Understanding the storage-to-refill ratio by region allows companies to optimize inventory to reduce waste from expired or unsold products. In FMCG, where shelf life is often short, monitoring this balance helps prevent overstocking in low-demand areas and improves overall inventory efficiency.

With a visual representation of refill versus storage, managers can quickly adjust refill strategies in real time. For example, high refills with low storage levels in one region might signal a need for increased inventory, while excess storage in another region might indicate areas to reduce or repurpose inventory.

Maintaining the right balance between storage and refills ensures consistent product availability, which is key to customer satisfaction. Understanding and adjusting inventory levels by region enables faster response to customer needs, helping avoid stockouts in high-demand areas and minimizing overstock in slower-moving regions.

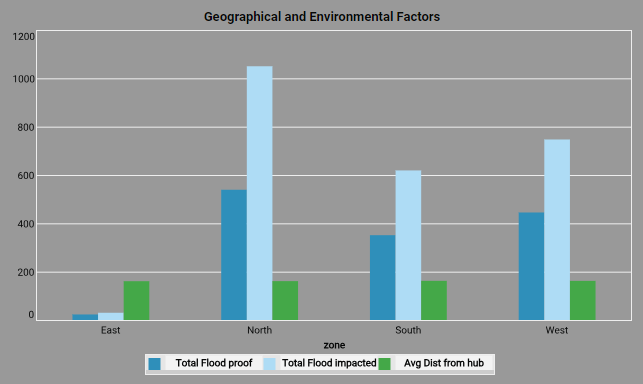

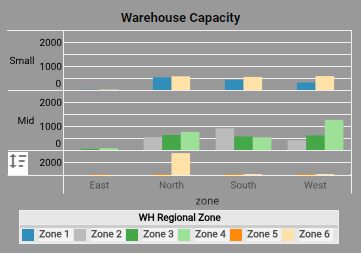

Warehouse Capacity

This multidimensional chart helps decision-makers allocate resources by showing the distribution of storage capacities. Smaller warehouses may require more frequent replenishments, while larger warehouses may serve as central hubs with extended inventory cycles. This insight allows for better planning of storage space and inventory distribution.

A clear view of warehouse capacities helps manage refill schedules effectively. Smaller warehouses can be prioritized for faster replenishments to prevent stockouts, while larger ones can hold backup stock, reducing the frequency of refills and optimizing refill logistics.

Understanding the capacity of each warehouse in different regions also enables efficient distribution planning. High-capacity warehouses in high-demand zones can serve as primary distribution centers, reducing transportation costs and improving delivery speed to nearby areas. Smaller warehouses in lower-demand areas can be stocked to support specific regional needs without overcommitting resources.

Being mindful of areas with limited storage. allows for contingency planning, where high-demand areas with smaller storage can be supported by nearby large-capacity warehouses, enhancing the supply chain's flexibility to respond to fluctuations in demand.

Efficiently managing warehouse capacity in relation to regional demand minimizes unnecessary transportation and storage costs. High-capacity warehouses can be strategically placed near high-consumption areas, while lower-demand regions can rely on smaller facilities, balancing transportation costs and storage efficiency. During peak seasons or promotional periods, larger warehouses can stock more inventory to support increased demand, while smaller ones can receive temporary additional stock as needed. The chart aids in pre-planning for these periods by assessing warehouse capacity and strategizing inventory levels accordingly.

The chart also serves as a valuable tool for planning future warehouse expansions. Low-capacity warehouses in high-growth regions might signal a need for expansion, while underutilized capacity in certain areas could indicate an opportunity to consolidate storage space. This data-d

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |