InetSoft Webinar: A New Financial Reporting Toolset

This is the transcript of a Webinar hosted by InetSoft on the topic of "Demonstrating Financial and HR Reporting." The speaker is Mark Flaherty, CMO at InetSoft.

We have the next 45 minutes set aside to focus on a new financial reporting toolset that will give you access to your financial system data, so you can write reports in minutes. It’s our pleasure to share with you a proven reporting solution. Based on the registration details, some of you have heard about the solution from your peers. We thank them for spreading the good news.

So how can you create your financial reports within minutes? Really, we have been asked a lot, is it that easy? The answer is yes. First, we will walk through the reporting solution, and answer some of the questions that you have. Next, we will create a report in minutes. We will walk through some financial reporting exercises.

Then we will walk through human capital management exercises. You will have a view of the standard reports. Then we will look at how you can schedule these reports. Then we will show you how you can use query and analysis tools to write some analyses and reports.

So what is query and analysis? It’s a reporting tool and an analysis toolset that is proven. I mentioned that earlier, it’s used by over 3,000 InetSoft customers globally every day. It gives you real-time access to your financial data. It’s very easy to learn.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

You will see that as we go through the presentation that it integrates with the Microsoft Office suite. And the most important thing is you can have this up and running within a week. Hard to believe, but yes, one week.

So what does that really mean to you? Let's take a look. It means you have access to your financial data, any file and field that’s in the financial system, whether it’s JDE or QuickBooks. You won't need to go to make any table joins on your own. For some of you that have been around a long time like the rest of us, that means joining some of your HR files together or your finance files. We’ve provide a simple but powerful data mashup tool that lets you point and click, and drag and drop to select any of the fields within these systems. You can also filter and display on any of those fields for output. And did we mention you can have this up and running in a week?

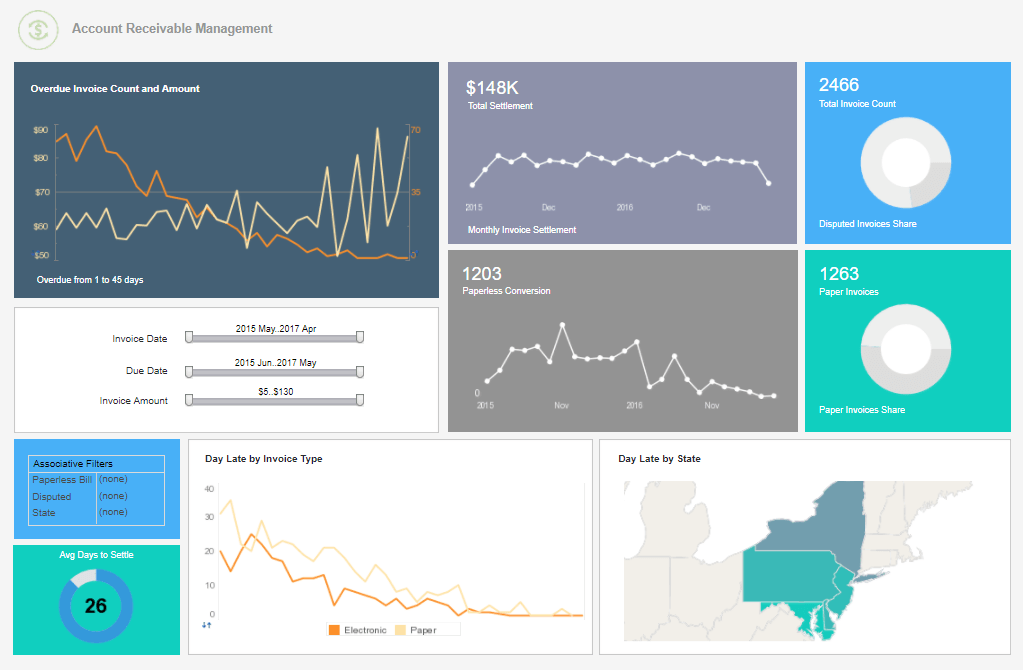

So how does it work from an integration standpoint? Integration is delivered to you via the InetSoft data access platform. Different connectors access different systems. One is for financial data, such as general ledger, payroll ledger, fixed assets and accounts receivable. The second is for human capital management, bringing together human resources, payroll and benefit administration. Any of this data can be mashed up with other databases you may have in your enterprise.

So what do you need to technically run this reporting suite. This is the technical slide that’s available for some of you that are on the line from the IT department and/or you can share this information with your IT department. Also available upon request is a more detailed technical white paper. Now let's go and show you what you can work with and how you can create reports in minutes. Let’s walk you through creating some financial reports.

Read what InetSoft customers and partners have said about their selection of Style Scope for their solution for dashboard reporting. |

Many of these accounts payable people that I have talked to over the years have told me often how they get requests for information. A particular request might be, can they get a summary report of vendors showing the total amount and perhaps even a count of invoices. Well, yes, you can. Maybe you can do it in minutes.

One way to start is by clicking on the Report Wizard. And when you launch the wizard, you will notice that you have so many options. One option might be to select a detailed report. The other is a summary report. For this particular report, select summary. And here you will see the two databases to query, the financial and the human capital management ones.

Selecting the financial table, when you open this up, you will see that there is the information for payables and for general ledger. In general ledger, you will notice that there is chart of accounts information, general information, account balances, and budgets. For fixed assets, you will see that there is not only the fixed assets information, there the asset book information is available as well. In accounts receivable, you have customer files, obligation files, cash receipts. All that information is at your fingertips.

| Next: Create a Financial Report |