InetSoft Podcast: New Insurance Industry Analytics

This an excerpt of a podcast interview about new insurance industry analytics. The speaker is Jessica Little, Marketing Manager at InetSoft.

Interviewer: Tell us about current generation claims analytics, and in your opinion, why they are not so good?

Little: Well, I think, unfortunately, in most claims departments, information is divided up into data silos, and that includes claims management systems that can only provide basic and limited reporting to separate litigation management systems as well as separate reinsurance systems and customer data repositories, just to name a few.

The problem with this is that fractured data leads to obviously a number of issues that impede success. So for instance, when a claims operation accesses data from multiple data basis, there is no one single version of the truth or claim. So there is a greater likelihood that the claims adjuster may get multiple answers, right or wrong, from the data.

Further exacerbating to the claims handler is the fact that he or she may have to go to multiple source systems or people for an answer. So this is obviously very costly for a claims organization, especially since you consider that a lot of claims organizations are under a lot of cost takeout needs and controls right now.

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

So this type of scenario can lead a claims organization to really be in a very reactive mode of operation because there is an incomplete picture of a class of claims, and it certainly limits the ability to do next generation types of claims analytics.

Interviewer: Okay, Jessica, and bring us up-to-date, tell us about the next generation claims analytics?

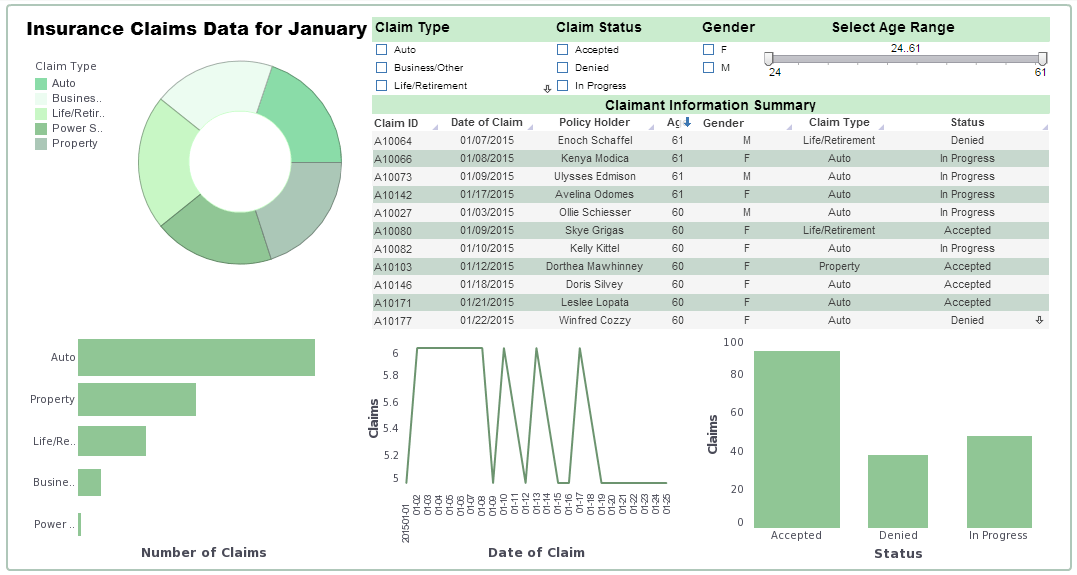

Little: Well, sure. An integrated claims data warehouse, and I am just focusing on claims, it allows really for one view of the claims business and provides an empowerment of claims end-users to access data via claims portals and analytic tool. So the manual searching for information is limited, and claims folks are better prepared to make decisions on claims because they are simply more empowered with data.

The integrated claims approach can quickly supplement information to the individual claims systems that current carriers have. So more importantly, or most importantly, an integrated claims data warehouse could provide one view of the claims business that can accurately and timely support our claims dashboarding connection with, say, a claims manager’s needs for an operation view of the department.

As more data is integrated, the claims’ business value compounds exponentially while the investment definitely increases incrementally. So carriers will find that as they add and integrate more claims data in the warehouse, they can answer more questions more quickly and deeply and enable predictive analytic applications to save money by reducing claims leakage and reducing inefficiency.

|

Read how InetSoft was rated as a top BI vendor in G2 Crowd's user survey-based index. |

All this happens while their total cost of ownership of a dedicated claims warehouse really decreases. The combination of such an integrated claims foundation with predictive analytics and mining tools will enable claims organizations to achieve numerous benefits.

A lot of that comes down to the ability to be able to proactively use an ad hoc reporting tool and others types of automation including claims fast tracking, new claims triage, identifying fraudulent claims and potentially litigation early in the cycle, and again, this translates into reduced operational cost, allocated expense and loss for the company.