InetSoft Webinar: The Problems With a Manual Financial Budgeting and Financial Reporting Process

This is the continuation of the transcript of a Webinar hosted by InetSoft on the topic of "Web Based Reporting, Budgeting, and Forecasting." The speaker is Mark Flaherty, CMO at InetSoft.

Continuing on with the problems with a manual financial budgeting and reporting process, major scenario

changes as we talked about. After a round of compilation, you find out that they want to increase gross

profit, or they need to reduce operating expenditures by another 10%. You have to go through the process

again. Where do you get those reductions? Now I am going to talk a little bit about it being an inverted

process. In the inverted process, meaning that typically in a budgeting scenario management gets together, and

they set goals, high level expectations. Those goals were then formulated in the measurements and as they

trickled out to all the people that need to use them, managers of the operations. In reality, when you look at

the budget process as laid out, the templates start at the departmental level because management wants to see

if they have our goals first, and when they don’t that’s obviously where the pain points come in.

So in moving through this budget and planning process, and you consider Web based reporting and budgeting application, you want to take this opportunity to align your business processes to achieving your business objectives. And you want to streamline your operations. You don’t want to revisit this at multiple times. What do you expect from a Web based budgeting system?

You expect to align your process of distributing information about the strategic plan, the measurements and assumptions, and disseminate that through a Web based planning application. What would be the advantages of this Web based financial planning application be? One, it’s a single secure point of entry. The idea is you don’t have people that can give templates to the other individuals that I am not aware. You can identify every user who logs in. When they log on, they only see the information that they are supposed to see and can only perform the tasks such as data entry for what they are allowed to.

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

Next is the accessibility or the immediate distribution and updating of those manual processes. Distributing the templates, compiling the templates, if you can get this on to the Web, you obviously eliminate all of that those manual processes by the idea that somebody is going to enter it, submit it, and you will immediately have it. You can see that it’s updated from one central spot. You want to still be able to provide a worksheet.

As those of you that do a lot of budgeting obviously know, it is not just operating expenses and revenue, but we are budgeting salary which is very secured detailed information. We are also budgeting things like capital budgets or asset acquisitions for the year for cash flow purposes. So you have got multiple tiers that this financial reporting application should address.

You are streamlining the compilation of budgets and then ultimately improving the review process with good

analytics. When we say review analytics, this isn’t much just by the stakeholders, but you really want

your budget holders and the people that have to do the data entry, you want them to able to see right off the

bat if the information they entered is acceptable.

Should they be manipulating the numbers before they even submit them because they didn’t meet the goals and objectives of the organization as they have been outlined. The budget controller not only wants to see the numbers, but he wants to make sure that their input is complete. Everybody is uploaded, and you are ready to go and consolidate.

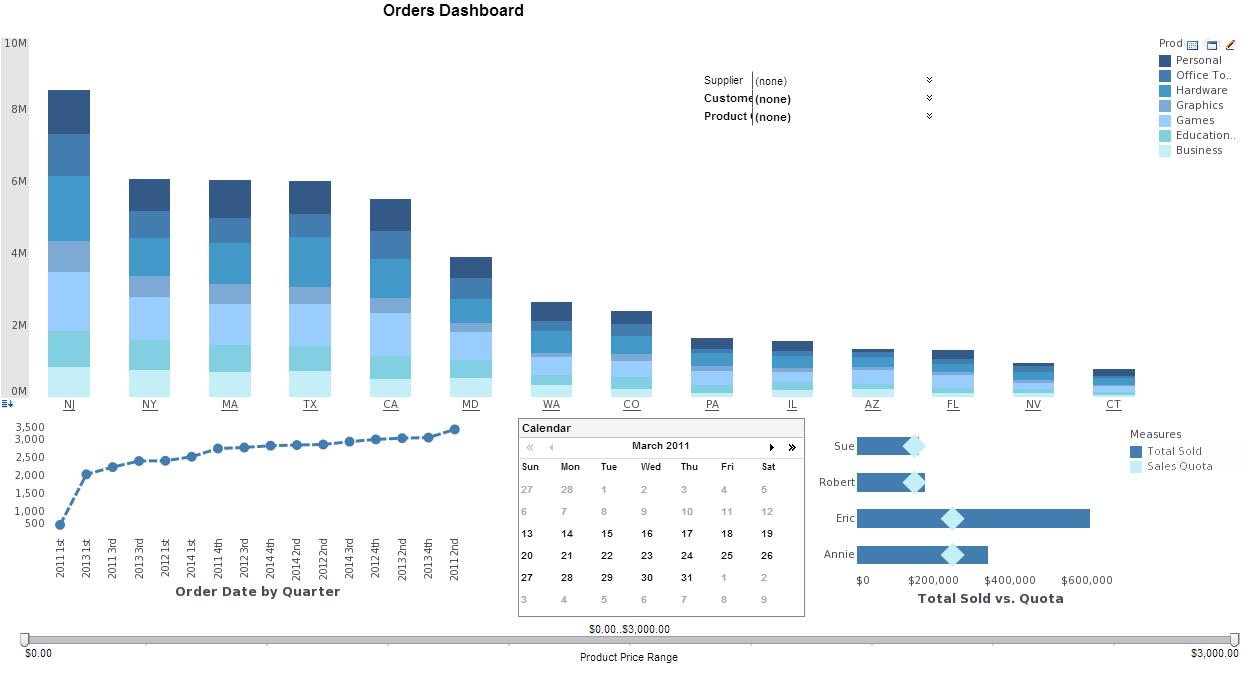

So with that said what I would like to do is actually go right into the financial reporting and budgeting product and talk about the Web based budgeting and reporting solution from the standpoint of what it looks like in the application. I am going to share my desktop. Here I am going to actually open up internet explorer. Now I have set this up pretty simply just to give you an idea of what a Web based budgeting and reporting system looks like, how it functions, or how it can function.

| Previous: Web Based Reporting, Budgeting, and Forecasting Applications |