InetSoft Webinar: Business Intelligence for CRM

This is the transcript of a Webinar hosted by InetSoft on the topic of "Business Intelligence for CRM." The speaker is Mark Flaherty, CMO at InetSoft.

Good day and welcome to our Webinar on Business Intelligence for CRM. This is a very important topic, and in today’s discussion really we are going to focus on driving intelligent customer interactions with CRM analytics. It's a topic that in my humble observation is not sufficiently spotlighted. What we are going to look at today is this whole area of intelligent customer interactions.

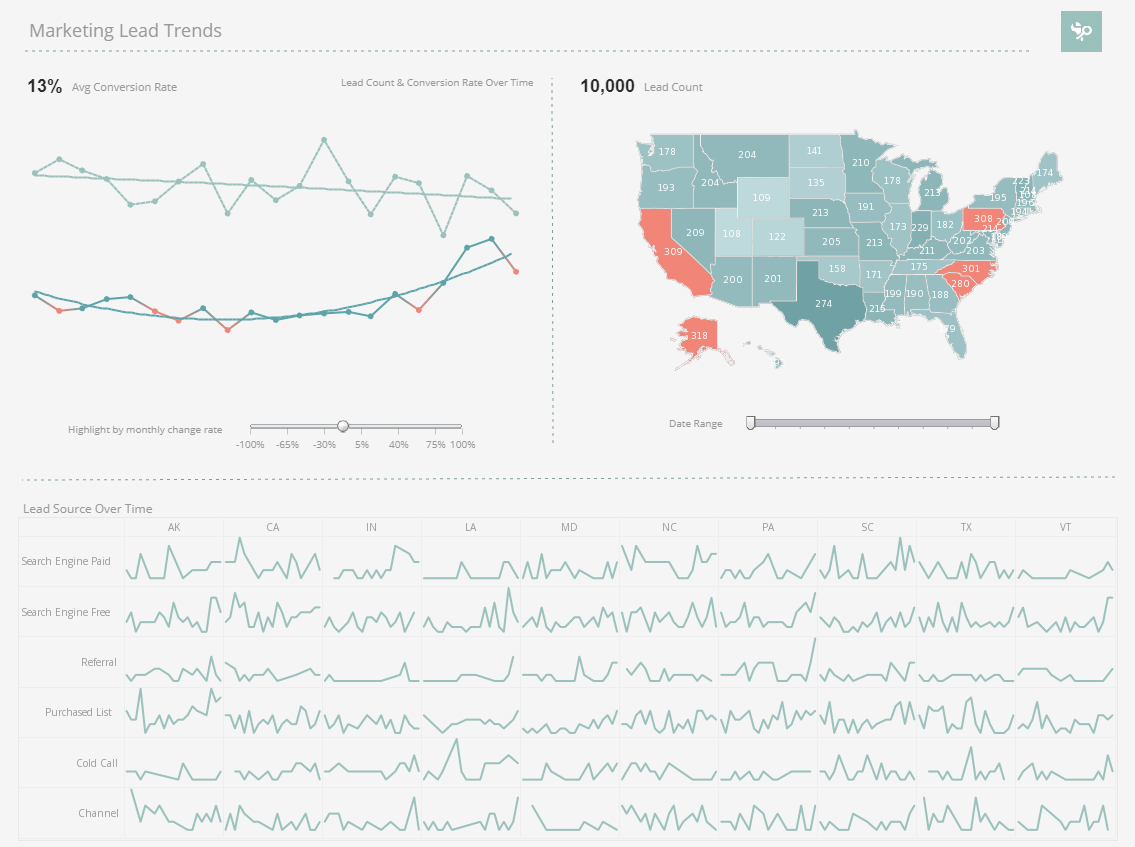

As this economy moves along we need to be very careful how we are going to spend our money. Who are we going to target? What types of leads are we really going to pay attention to? The goal is to move more business down the pipe or through the funnel and drive new business to our respective organizations.

The key point here is the better a job we do at knowing our customers now during tough times the better the performance as we move out of this particular downturn. And it would be again my humble observation that intelligent customer interactions are the way to help drive, retain, and strengthen market share.

It always surprises me, but about 75% of senior marketers do not use analytical tools to make decisions. Now you could argue that marketing is half science and half art, and therefore you know half of it does need to use analytical tools, and half of the decisions don’t require analytical tools.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

But to make good judgments and decisions, and often that’s what marketers do, that analytical component is absolutely critical for the reason that we are going to be discussing over the next 50 or so minutes. So the big question is, is it okay to shoot from the hip, to take the shotgun and shoot for that big flock of birds, or should we really be using these customer analytics to make better decisions. Needless to say that’s my rhetorical question, and my response is you would be foolish to use the big gun and shoot at the flock of birds. Best in class, best organizations in the world only use analytics to make their better decisions.

Now at the heart of good decision making and at the heart of understanding customer interactions intelligently is the customer profile, and I am going to spend 5 or 10 minutes on this because I feel very strongly that a good and well kept customer profile will drive intelligent customer interactions and poorly kept up customer profile will not allow for intelligent customer interactions.

With this example customer profile, you can see starting on the upper left hand green bubble, you know the typical stuff: name, phone, address, and e-mail contact preference. Then we get it to some customer information in the purple bubble one over, the status of this customer, the type of triple membership they have, the needs that are suggested, the years of service they have, and lastly what the customer may have for follow on activities or they had requested for us to do. We also have a history of any type of an activity that resulted from an interaction with that particular customer. We have got knowledge of the products coming from the back office in terms of did they buy travel or emergency road service insurance etc.

We know again from the financial system what type of value they bring, life time value to our company and maybe some credit scores. But then the operational issues in the next bubble, they come from back office operation systems in terms of outstanding claims or outstanding billing issues. We also have customer service in the next bubble. These are either current service issues or historic issues.

Read what InetSoft customers and partners have said about their selection of Style Scope for their solution for dashboard reporting. |

We don’t step on a landmine when we discuss something with a customer. I always like that competitive information in the profile to tell me if they don’t buy from me, who do they buy from, so that when I have a special way of addressing the competition I know who to pull out in my analytics. The marketing section shows what they responded to in terms of campaigns, and you will see in a minute that is very important.

This is self learning as to what they responded to as well as potential cross and up sell and next best offer opportunities. In relationships you see what relationships the customer may have with others and also the relationship with us. And this is indicative.

Now the value add of the profile is straight forward. You get a holistic view of the customer. All customer facing personnel conceptually have the right to see the same views. You can turn these profile views on and off based on need to know. The key point is everybody has the same information, and all that really does help with servicing customers with knowing how to best to market to the customers and ultimately sell to customers.