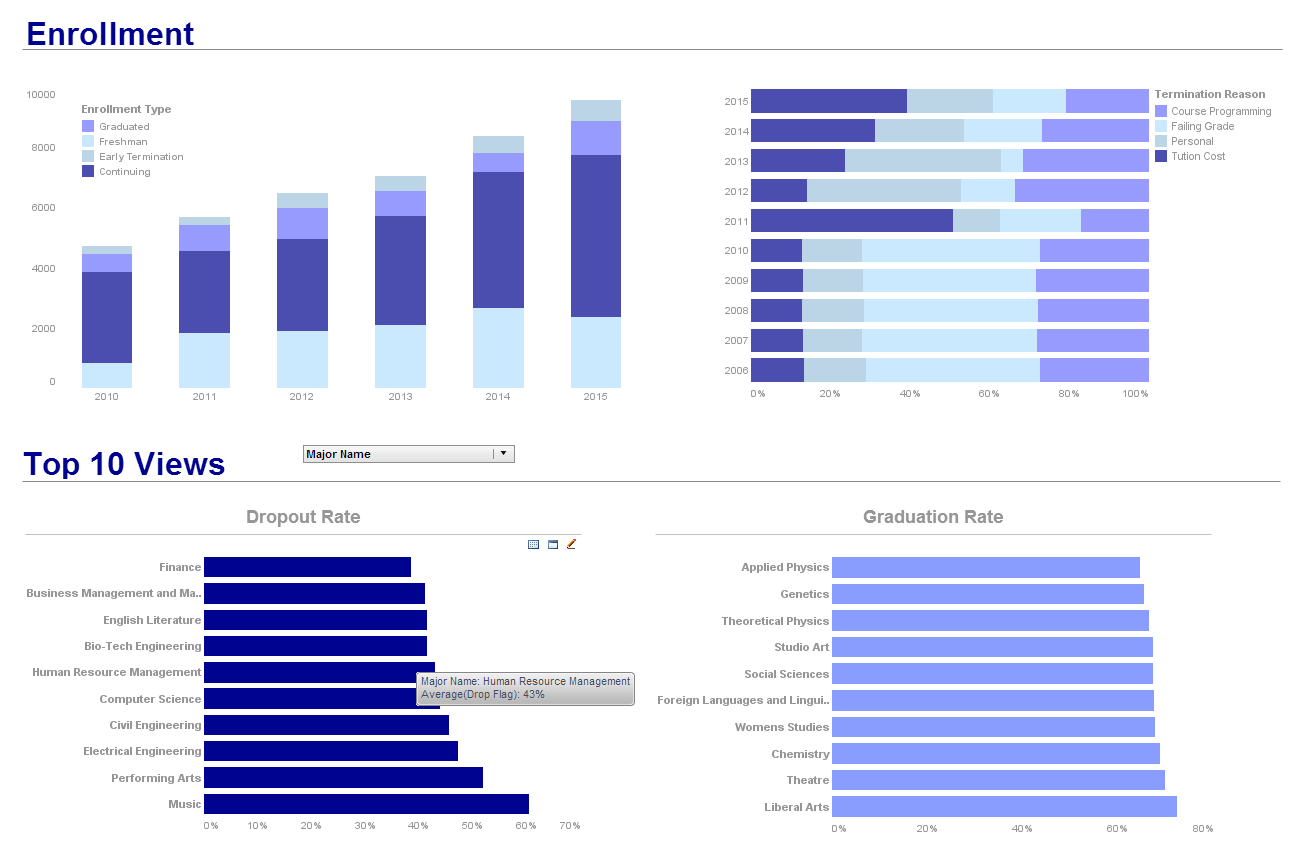

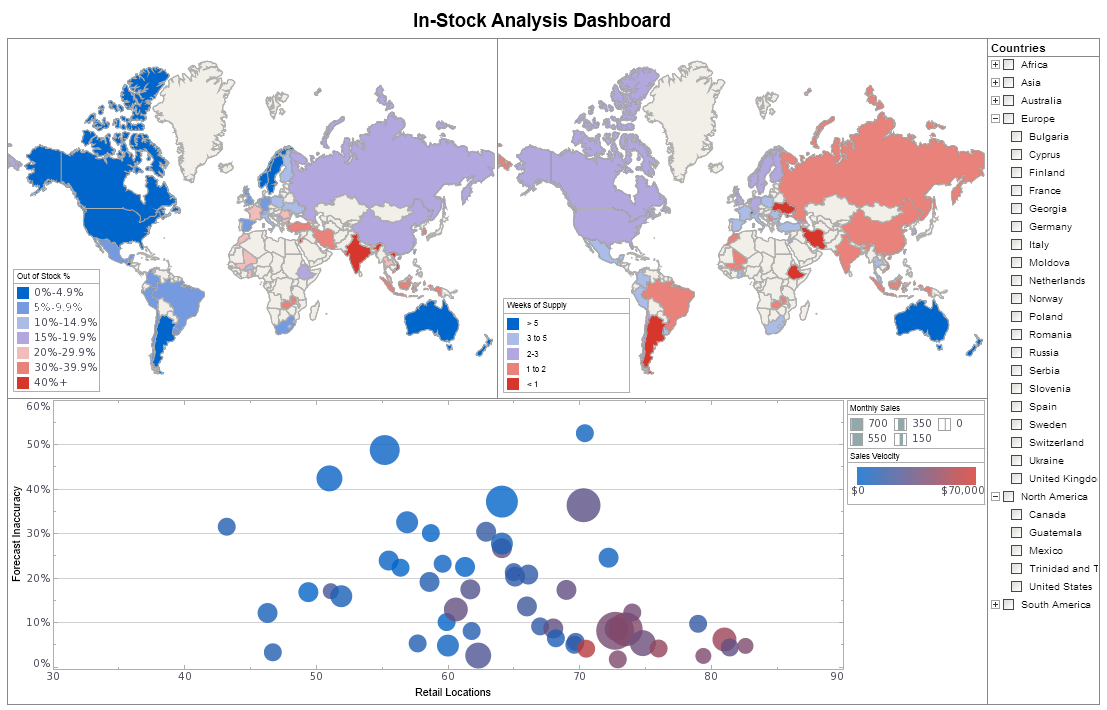

Try InetSoft's Performance Dashboard Solution

Are you looking for a demo of the top performance dashboard software? Since 1996 InetSoft has been making dashboard software that is easy to deploy and easy to use. Build self-service oriented dashboards quickly. View a demo and read customer reviews from some of the 5,000+ happy customers.

|

View a 2-minute demonstration of InetSoft's easy, agile, and robust BI software. |

Why InetSoft?

InetSoft's mobile BI reporting application is easy enough to be:

- Deployed in just weeks

- Learned by end users with minimal training

- Used by any executive without the aid of IT

agile enough to be:

- Adaptable to changing data and business needs

- Used for data exploration through visualization

- Capable of maximum self-service

and robust enough to:

- Attract the attention of executives

- Meet the demands of power users

- Scale up for organizations of any size

Evaluate StyleBI from InetSoft. It's Easy. Agile. & Robust.

Register for more info and to download free eval software

About InetSoft

Since 1996 InetSoft has been delivering easy, agile, and robust business intelligence software that makes it possible for organizations and solution providers of all sizes to deploy or embed full-featured business intelligence solutions. Application highlights include visually-compelling and interactive dashboards that ensure greater end-user adoption plus pixel-perfect report generation, scheduling, and bursting. InetSoft's patent pending Data Block technology enables productive reuse of queries and a unique capability for end-user defined data mashup.

This capability combined with efficient information access enabled by InetSoft's visual analysis technologies allows maximum self-service that benefits the average business user, the IT administrator, and the developer. InetSoft was rated #1 in Butler Analytics Business Analytics Yearbook, and InetSoft's BI solutions have been deployed at over 5,000 organizations worldwide, including 25% of Fortune 500 companies, spanning all types of industries.

What KPIs and Metrics Are Tracked in Health Insurance Provider Dashboards?

Health insurance providers operate in a complex environment that requires meticulous management of resources, regulatory compliance, and customer satisfaction. To navigate this landscape effectively, providers rely on a range of Key Performance Indicators (KPIs) and metrics displayed on dashboards. These KPIs offer insights into operational efficiency, financial health, service quality, and customer satisfaction, guiding decision-makers in enhancing overall performance. Below are some essential KPIs and metrics tracked in health insurance provider dashboards, along with their definitions and significance in performance management.

1. Claims Processing Time

- Definition: The average time taken to process and resolve a claim from submission to final decision.

- Significance: This KPI is crucial for customer satisfaction. Faster claims processing improves customer experience and reduces operational bottlenecks. Efficient claims processing can also lead to cost savings by minimizing administrative overhead.

2. Claims Denial Rate

- Definition: The percentage of claims that are denied out of the total claims received.

- Significance: A high denial rate can indicate potential issues with policy terms clarity, customer communication, or claims processing efficiency. Reducing the denial rate improves customer satisfaction and reduces the administrative burden of handling appeals and re-submissions.

3. Customer Satisfaction (CSAT)

- Definition: A measure of how satisfied customers are with the insurance services, often obtained through surveys and feedback forms.

- Significance: High customer satisfaction is critical for retention and positive word-of-mouth referrals. Monitoring CSAT helps in identifying areas where service improvements are needed.

4. Net Promoter Score (NPS)

- Definition: A metric that gauges customer loyalty by asking how likely they are to recommend the insurance provider to others.

- Significance: A high NPS indicates strong customer loyalty and satisfaction, which are key to retaining customers and attracting new ones. It provides a clear measure of overall customer sentiment.

5. First Call Resolution (FCR)

- Definition: The percentage of customer inquiries or issues resolved on the first contact with customer service.

- Significance: High FCR rates indicate effective and efficient customer service operations. It reduces the need for follow-up calls, improving customer satisfaction and reducing operational costs.

6. Cost per Claim

- Definition: The average cost incurred by the insurance provider to process a single claim.

- Significance: This metric helps in understanding the efficiency of the claims processing operation. Lowering the cost per claim without compromising quality can lead to significant cost savings.

7. Loss Ratio

- Definition: The ratio of total claims paid to the total premiums earned.

- Significance: The loss ratio provides insight into the financial health of the insurance provider. A lower loss ratio indicates better profitability, whereas a higher ratio might suggest that the company is paying out too much in claims relative to its premium income.

8. Medical Cost Trend

- Definition: The rate at which medical costs are increasing over a specified period.

- Significance: Tracking the medical cost trend helps in anticipating future costs and setting appropriate premium rates. It is crucial for maintaining financial stability and competitiveness.

9. Member Retention Rate

- Definition: The percentage of members who renew their policies at the end of the coverage period.

- Significance: High retention rates indicate customer satisfaction and loyalty. Retaining existing members is often more cost-effective than acquiring new ones, making this a critical KPI for long-term success.

10. Policy Sales Growth

- Definition: The rate at which new policies are being sold over a specific period.

- Significance: This metric reflects the effectiveness of marketing and sales strategies. Positive sales growth is essential for expanding the customer base and increasing market share.

11. Provider Network Size

- Definition: The total number of healthcare providers within the insurance network.

- Significance: A larger network size can enhance the attractiveness of the insurance plan to potential customers, offering them more choices and potentially reducing out-of-pocket expenses.

12. Provider Satisfaction

- Definition: A measure of how satisfied healthcare providers are with their interactions and relationships with the insurance company.

- Significance: Satisfied providers are more likely to deliver better care to members and engage positively with the insurance provider, leading to smoother operations and higher member satisfaction.

13. Utilization Rate

- Definition: The rate at which members use their insurance benefits, often measured in terms of doctor visits, hospital stays, or procedures per 1,000 members.

- Significance: Understanding utilization rates helps in managing costs and ensuring members are using their benefits appropriately. It can also indicate areas where additional member education might be needed.

14. Chronic Disease Management

- Definition: Metrics related to the management of chronic diseases among members, such as adherence to treatment plans and regular monitoring.

- Significance: Effective chronic disease management can improve member health outcomes and reduce long-term costs by preventing complications and hospitalizations.

15. Risk Adjustment Factor (RAF)

- Definition: A measure used to adjust payments based on the health risk profile of the insured population.

- Significance: Accurate RAF calculations ensure that the insurance provider is adequately compensated for covering higher-risk individuals, which is essential for maintaining financial balance.

16. Operational Efficiency

- Definition: A composite metric that includes various factors such as administrative cost ratio, processing speed, and resource utilization.

- Significance: High operational efficiency means that the insurance provider can deliver services more cost-effectively, improving profitability and competitiveness.

17. Compliance Rate

- Definition: The percentage of operations and processes that comply with regulatory standards and internal policies.

- Significance: Ensuring high compliance rates reduces the risk of legal penalties and enhances the company's reputation for reliability and integrity.

18. Employee Productivity

- Definition: Metrics related to the output and performance of employees, such as the number of claims processed per employee.

- Significance: Higher employee productivity can lower operational costs and improve service delivery times, contributing to better overall performance.

19. Member Engagement

- Definition: The level of interaction and involvement members have with their health insurance plan, such as participation in wellness programs or usage of online portals.

- Significance: High member engagement often leads to better health outcomes and higher satisfaction, as engaged members are more likely to utilize preventive care and understand their benefits.

20. Fraud Detection and Prevention

- Definition: Metrics related to the identification and prevention of fraudulent claims and activities.

- Significance: Effective fraud detection reduces unnecessary costs and protects the financial integrity of the insurance provider. It also ensures that legitimate claims are processed more efficiently.

Significance in Performance Management

Enhancing Customer Satisfaction

Tracking KPIs such as customer satisfaction, NPS, and first call resolution provides insights into the customer experience. High performance in these areas indicates that the insurance provider is meeting or exceeding customer expectations, which is crucial for retention and attracting new customers. By addressing areas where satisfaction is low, companies can implement targeted improvements to enhance overall service quality.

Financial Stability and Profitability

Metrics like the loss ratio, cost per claim, and medical cost trend are vital for maintaining financial health. These KPIs help insurance providers manage their costs effectively and set appropriate premium rates. Ensuring a healthy loss ratio and controlling costs lead to better profitability and long-term sustainability.

Operational Efficiency

KPIs such as claims processing time, operational efficiency, and employee productivity are essential for streamlining operations. Efficient processes reduce administrative overhead and improve service delivery, which benefits both the provider and the customers. High operational efficiency also enables the company to handle higher volumes of claims and policy sales without compromising quality.

Compliance and Risk Management

Compliance rate and fraud detection metrics are critical for mitigating legal and financial risks. Ensuring that operations comply with regulatory standards protects the company from legal penalties and enhances its reputation. Effective fraud detection and prevention safeguard the company's financial resources, ensuring that funds are available for legitimate claims.

Strategic Planning and Growth

Metrics like policy sales growth, member retention rate, and provider network size provide insights into the company's market position and growth potential. By monitoring these KPIs, insurance providers can develop strategic initiatives to expand their market share, attract new customers, and retain existing ones. A larger provider network and high member retention rates are indicators of a robust and attractive insurance plan.

|

Read how InetSoft was rated as a top BI vendor in G2 Crowd's user survey-based index. |

More Articles About Perforance Dashboards

31 Must-Have Features of Good Dashboard Software - Dashboards and analyses have to be shareable over public or private networks with the ability to choose whether to share them publicly or privately. A good dashboard solution has to facilitate teamwork. Rarely is a dashboard useful to only one person, and the point of contributing to business performance improvement is sharing insights or calls-to-action. You should be able to share them via a URL which people can bookmark or simply by email as a snapshot. When security and confidentiality is important, then recipients should either have to have the same corporate domain or login with a username and password...

Geographic Heat Map Visualization - Now the manager clicks on the spike in the bar chart and the map on the right hand side updates to show that town with crime reports marked on the map using a heat map visualization. The hot red shows the problem areas. Also depicted on the map are the locations of youth services such as clubs. At first glance it seemed that in the areas not affected by juvenile crime, there are a scattering of youth services. Within the problem area, there are already a number of youth organizations. At first glance, it doesn't appear that the number of youth service locations is a key issue...

Perspectives on Balance Scorecard Use - I use what are called the balance scorecard use perspectives. I use what I call service areas. Service areas are really just natural grouping of services. It could be chronological or sequential, whatever makes sense to you and your organization, but the idea, folks, we are not reorganizing. We're not rewriting your org chart. We are creating a framework for you to begin to see performance dependencies as they emerge...

What Is the Ideal Business Intelligence Setup? - The ideal business intelligence setup here, and I want to stress that this is the ideal is that you would have every employee working from the same version of truth. Now, this is a ideal of perfection. There are hardly any companies out there who have that one perfect, single version of the truth, but the idea is that manufacturing companies are starting to take a look at. They realize that good information is the most valuable commodity. If this is the way they were going to compete going forward, then shouldn't they have a higher quality of information. It should be thought of just as they strive to create quality products...