Budget Monitoring Dashboards

Style Intelligence is an easy, agile, and robust platform to help you to quickly respond to over spending and budgeting issues before they becomes a problem.

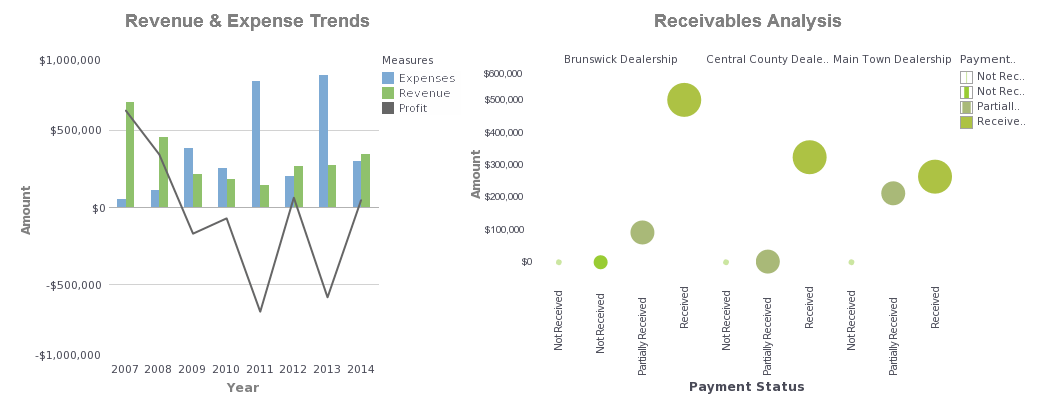

Overview dashboard: Use the financial visualization tools to track how your company is spending and what your supplier is doing to keep the goods rolling in.Performance metrics: Gauge long term and short term goals and objectives with drill down details from multiple sources. Check actual against budgeted expenses in one fell swoop with customized charts and mini spreadsheets to make reporting easy.

Competitive market benchmarking: Compare your performance against the market with dozens of KPIs easily displayed through user friendly portal interfaces.

Ledgers and statements: Customization is the key word with our monitoring dashboards. Automatically generate trend lines based on actual performance and variances. Manipulate tabular reports with Excel and measure your performance versus goals and commitments with great agility.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Mashups for Better Budget Monitoring

Style Intelligence can pull your financial data from your operational financial systems and combine it with almost any other data source found in your enterprise including: relational databases (JDBC), multidimensional databases, XML, SOAP, dozens of cloud sources, Excel spreadsheets, OLAP cubes, and the proprietary data stores from JDE, SAP, PeopleSoft, and Siebel CRM.

In addition, InetSoft has innovated unique capabilities for budgetary mashups. You do not have to be a BI analyst to create your own mashups. You can combine disparate tables and fields that were not previously mapped in a data model. Moreover, you can also bring in your own data sets such as those in personal spreadsheets or those generated by vendors or partners. Whatever dashboards or reports you make from them are now shareable inside the financial BI space.

What KPIs and Metrics Are Tracked in Budget Monitoring Dashboards?

1. Budget Variance

Definition: Budget variance measures the difference between budgeted amounts and actual figures for a specific period. It is calculated as: Budget Variance=Actual Value−Budgeted Value\text{Budget Variance} = \text{Actual Value} - \text{Budgeted Value}Budget Variance=Actual Value−Budgeted Value Significance: Budget variance is crucial for identifying discrepancies between planned and actual financial performance. Positive variances (actual is less than budgeted) indicate cost savings, while negative variances (actual exceeds budgeted) signal overspending. Monitoring variances helps in taking corrective actions and adjusting future budgets.

2. Revenue and Expense Forecast Accuracy

Definition: This KPI compares forecasted revenues and expenses with actual outcomes. It is often expressed as a percentage: Forecast Accuracy=(Actual ValueForecasted Value)×100\text{Forecast Accuracy} = \left( \frac{\text{Actual Value}}{\text{Forecasted Value}} \right) \times 100Forecast Accuracy=(Forecasted ValueActual Value)×100 Significance: Forecast accuracy indicates the reliability of financial projections. High accuracy reflects effective planning and prediction capabilities, whereas low accuracy may necessitate revising forecasting models and assumptions.

3. Cash Flow

Definition: Cash flow tracks the net amount of cash being transferred into and out of the business. It includes operating, investing, and financing activities. Significance: Positive cash flow ensures that the organization can meet its obligations, invest in growth, and sustain operations. Monitoring cash flow is vital for maintaining liquidity and financial stability.

4. Operating Margin

Definition: Operating margin is a profitability ratio that measures the percentage of profit a company makes from its operations, before subtracting taxes and interest. It is calculated as: Operating Margin=(Operating IncomeTotal Revenue)×100\text{Operating Margin} = \left( \frac{\text{Operating Income}}{\text{Total Revenue}} \right) \times 100Operating Margin=(Total RevenueOperating Income)×100 Significance: This metric helps assess the efficiency of the company's core business operations. A higher operating margin indicates better control over operating expenses relative to revenue, contributing to overall profitability.

5. Gross Profit Margin

Definition: Gross profit margin is the ratio of gross profit to total revenue, expressed as a percentage. It is calculated as: Gross Profit Margin=(Gross ProfitTotal Revenue)×100\text{Gross Profit Margin} = \left( \frac{\text{Gross Profit}}{\text{Total Revenue}} \right) \times 100Gross Profit Margin=(Total RevenueGross Profit)×100 Significance: This KPI shows how well a company generates profit from sales after accounting for the cost of goods sold (COGS). It is essential for assessing production efficiency and pricing strategy.

6. Net Profit Margin

Definition: Net profit margin is the ratio of net profit to total revenue, indicating the percentage of revenue that remains as profit after all expenses have been deducted. It is calculated as: Net Profit Margin=(Net ProfitTotal Revenue)×100\text{Net Profit Margin} = \left( \frac{\text{Net Profit}}{\text{Total Revenue}} \right) \times 100Net Profit Margin=(Total RevenueNet Profit)×100 Significance: This metric provides a comprehensive view of profitability, considering all income and expenses. A higher net profit margin signifies effective cost management and strong financial performance.

7. Cost Per Unit

Definition: Cost per unit measures the total cost incurred to produce a single unit of product or service. It is calculated as: Cost Per Unit=Total Production CostNumber of Units Produced\text{Cost Per Unit} = \frac{\text{Total Production Cost}}{\text{Number of Units Produced}}Cost Per Unit=Number of Units ProducedTotal Production Cost Significance: This KPI helps in evaluating production efficiency and cost management. Lower cost per unit indicates better control over production costs, contributing to higher profitability.

8. Return on Investment (ROI)

Definition: ROI measures the profitability of an investment relative to its cost. It is calculated as: ROI=(Net Profit from Investment−Cost of InvestmentCost of Investment)×100\text{ROI} = \left( \frac{\text{Net Profit from Investment} - \text{Cost of Investment}}{\text{Cost of Investment}} \right) \times 100ROI=(Cost of InvestmentNet Profit from Investment−Cost of Investment)×100 Significance: ROI is critical for assessing the financial returns of investments and projects. High ROI indicates successful investments that contribute positively to the organization's financial health.

9. Expense Ratio

Definition: Expense ratio is the ratio of operating expenses to total revenue, expressed as a percentage. It is calculated as: Expense Ratio=(Total Operating ExpensesTotal Revenue)×100\text{Expense Ratio} = \left( \frac{\text{Total Operating Expenses}}{\text{Total Revenue}} \right) \times 100Expense Ratio=(Total RevenueTotal Operating Expenses)×100 Significance: This metric helps in monitoring and controlling operating expenses. A lower expense ratio signifies better cost management and higher profitability.

10. Working Capital

Definition: Working capital is the difference between current assets and current liabilities. It is calculated as: Working Capital=Current Assets−Current Liabilities\text{Working Capital} = \text{Current Assets} - \text{Current Liabilities}Working Capital=Current Assets−Current Liabilities Significance: Adequate working capital is essential for day-to-day operations and short-term financial health. It indicates the organization's ability to meet its short-term obligations and invest in growth opportunities.

11. Debt-to-Equity Ratio

Definition: The debt-to-equity ratio measures the relative proportion of shareholders' equity and debt used to finance a company's assets. It is calculated as: Debt-to-Equity Ratio=Total LiabilitiesShareholders' Equity\text{Debt-to-Equity Ratio} = \frac{\text{Total Liabilities}}{\text{Shareholders' Equity}}Debt-to-Equity Ratio=Shareholders' EquityTotal Liabilities Significance: This ratio provides insight into the company's financial leverage and risk level. A higher ratio indicates more debt financing, which could be riskier, while a lower ratio suggests more reliance on equity financing.

12. Accounts Receivable Turnover

Definition: Accounts receivable turnover measures how effectively a company collects its receivables. It is calculated as: Accounts Receivable Turnover=Net Credit SalesAverage Accounts Receivable\text{Accounts Receivable Turnover} = \frac{\text{Net Credit Sales}}{\text{Average Accounts Receivable}}Accounts Receivable Turnover=Average Accounts ReceivableNet Credit Sales Significance: This KPI indicates the efficiency of the company's credit and collection policies. Higher turnover signifies efficient collection processes and shorter collection periods.

13. Accounts Payable Turnover

Definition: Accounts payable turnover measures how quickly a company pays off its suppliers. It is calculated as: Accounts Payable Turnover=Cost of Goods SoldAverage Accounts Payable\text{Accounts Payable Turnover} = \frac{\text{Cost of Goods Sold}}{\text{Average Accounts Payable}}Accounts Payable Turnover=Average Accounts PayableCost of Goods Sold Significance: This metric helps in understanding the company's payment practices and liquidity management. Higher turnover indicates quicker payments to suppliers, which could enhance supplier relationships but might also affect cash flow.

14. Inventory Turnover

Definition: Inventory turnover measures how often inventory is sold and replaced over a period. It is calculated as: Inventory Turnover=Cost of Goods SoldAverage Inventory\text{Inventory Turnover} = \frac{\text{Cost of Goods Sold}}{\text{Average Inventory}}Inventory Turnover=Average InventoryCost of Goods Sold Significance: This KPI indicates inventory management efficiency. Higher turnover rates suggest effective inventory control and strong sales, while lower rates may indicate overstocking or slow-moving inventory.

15. Budget Utilization Rate

Definition: Budget utilization rate measures the proportion of the budget that has been spent over a specific period. It is calculated as: Budget Utilization Rate=(Actual ExpenditureTotal Budget)×100\text{Budget Utilization Rate} = \left( \frac{\text{Actual Expenditure}}{\text{Total Budget}} \right) \times 100Budget Utilization Rate=(Total BudgetActual Expenditure)×100 Significance: This metric helps in tracking spending relative to the budget. It ensures that resources are used efficiently and within the planned limits, preventing overspending.

Significance of KPIs in Performance Management

Performance Evaluation

KPIs provide a quantifiable basis for evaluating financial performance. By tracking these metrics, organizations can assess whether they are meeting their financial goals and objectives. This evaluation is crucial for identifying areas of improvement and ensuring accountability across departments.

Informed Decision-Making

Accurate and timely KPIs enable informed decision-making. Managers and stakeholders can use these insights to make strategic adjustments, allocate resources effectively, and respond to financial challenges proactively. For example, a significant budget variance might prompt a review of spending practices and lead to cost-saving measures.

Strategic Planning

KPIs are essential for strategic planning and forecasting. By analyzing historical data and current performance, organizations can set realistic financial targets, develop actionable plans, and anticipate future financial needs. This proactive approach helps in aligning financial strategies with overall business objectives.

Financial Control

Effective budget monitoring ensures financial control by tracking expenditures and revenues against the budget. KPIs like budget variance, expense ratio, and budget utilization rate provide early warnings of potential financial issues, allowing for timely interventions and adjustments.

Enhanced Transparency and Accountability

Regularly reporting and reviewing KPIs fosters transparency and accountability within the organization. It creates a culture of performance management where all stakeholders are aware of financial goals and their roles in achieving them. This transparency builds trust and encourages collaboration towards common financial objectives.

Continuous Improvement

KPIs facilitate continuous improvement by providing ongoing feedback on financial performance. Organizations can use this feedback to refine processes, improve efficiency, and enhance financial management practices. Continuous monitoring and improvement lead to better financial health and long-term sustainability.

More Articles About Monitoring Dashboards

Metrics Tracked in Work Order Dashboards - Work Order Completion Rate Definition: The percentage of work orders completed within a given time frame compared to the total number of work orders issued. Significance: This KPI measures the efficiency of the maintenance or service team. A high completion rate indicates effective workflow management and resource allocation. It also reflects the team's ability to meet deadlines and maintain operational continuity...

Overall Equipment Effectiveness (OEE) - The Overall Equipment Effectiveness indicator assesses both the effectiveness of the production process and the performance of industrial equipment. It has three crucial elements: Availability: This KPI evaluates equipment uptime by calculating the proportion of time it is accessible for production. Availability may be impacted by downtime brought on by repairs, malfunctions, or transitions...

Tool to Make Jump Line Charts Online for Free - To easily and quickly create Jump Line Charts online for free, create a Free Individual Account on the InetSoft website. You will then be able to upload a spreadsheet data set, as shown below. Once you have done that, you will be able to proceed past the Visualization Recommender, which can usually get you started creating a dashboard. Since the Recommender does not offer the Jump Line Chart as a suggestion, press the Full Editor button. Then proceed to build the Jump Line Chart as described in the previous section...

What Industries Heavily Rely on Business Mapping Software? - Retail and E-commerce: Retailers use mapping software to analyze customer demographics and behaviors. This helps them make informed decisions about store locations, inventory management, and targeted marketing campaigns. In my view, the retail industry benefits greatly from business mapping software as it allows for data-driven strategies that enhance customer experience and drive sales...