The Easy Way to Create a Dashboard

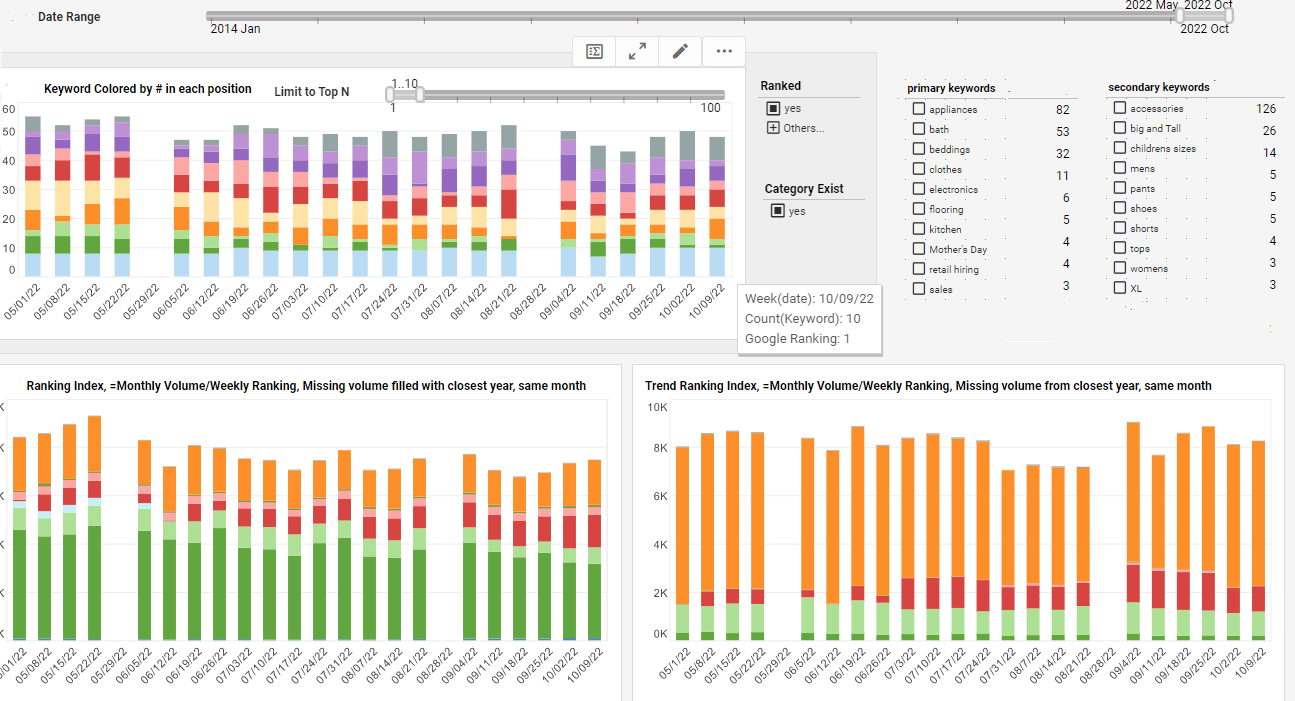

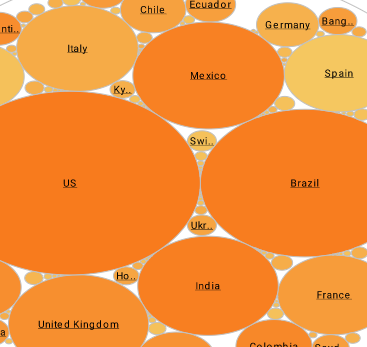

Creating a live dashboard is a simple and intuitive process with InetSoft's comprehensive real-time analytical reporting and dashboard software solution.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

A viewsheet dashboard consists of a single viewsheet. This top-level viewsheet can be designed to contain multiple nested viewsheets that present a variety of different information. To create a viewsheet dashboard, follow these steps:

- Under the Design tab, click the 'Dashboard' button.

- Click the 'New Dashboard' button under the 'Dashboards' table. This opens the 'Dashboard Properties' dialog box.

- In the 'Dashboard Name' field, enter a name for the new dashboard. This name will be displayed on the dashboard's tab in the Portal.

- (Optional) Enter a description for the dashboard in the 'Description' field. This description is only visible when the dashboard is being edited.

- Select 'Viewsheet Dashboard' as the 'Dashboard Type'.

- Click 'Apply' to open the 'Edit Dashboard' dialog box.

- In the 'Edit Dashboard' dialog box, choose a viewsheet from the 'Select Viewsheet' list. The viewsheet you select will be the top-level dashboard.

- Click 'OK'. This closes the 'Edit Dashboard' dialog box, and returns you to the main 'Dashboard' page.

The new dashboard is now listed in the 'Dashboards' table, and will be visible under the Dashboards tab of the Portal.

|

View live interactive examples in InetSoft's dashboard and visualization gallery. |

Ad Hoc Editing a Dashboard

To edit an Portlet or Viewsheet Dashboard that you have created, follow the steps below:

- Under the Design tab, click the 'Dashboard' button.

- Locate the dashboard you wish to edit in the 'Dashboards' table. (This table lists all of the user-defined dashboards. It does not list global dashboards defined by the administrator.)

- Click the 'Edit' button, located in the rightmost column, for the dashboard you wish to edit.

For a portlet dashboard, the 'Edit' button opens the 'Edit Dashboard' page. For a viewsheet dashboard, the 'Edit' button opens the 'Edit Dashboard' dialog box.

Alternatively, you can edit the dashboard as follows:

- Open the dashboard for viewing in the Dashboard tab of the Portal.

- Click the 'Edit Dashboard' link at the bottom-right corner of the browser window.

This will open the dashboard for editing as described above. If the dashboard is a global (administrator-defined) dashboard, this will create a copy of the global dashboard for you to edit.

To delete a dashboard entirely, Click the 'Delete' button in the rightmost column.

Case Study: Optimizing Operations and Performance at SecureFuture Pension Fund Management Using Dashboards

SecureFuture Pension Fund Management is a leading company that specializes in managing pension funds for a diverse range of clients, including corporations, government entities, and individual retirement accounts. With assets under management exceeding $50 billion, the company's success is heavily reliant on making informed decisions that balance risk, return, and client expectations. To achieve this, SecureFuture implemented a series of advanced dashboards designed to provide real-time insights into various aspects of their operations, investment strategies, and client management. This case study explores how SecureFuture utilized dashboards to optimize performance, enhance decision-making, and improve client satisfaction.

1. Investment Management: Enhancing Portfolio Performance

Challenges

The core of SecureFuture's business revolves around managing investment portfolios that meet the long-term retirement needs of their clients. The company faced challenges in tracking the performance of diverse asset classes, balancing risk across portfolios, and responding swiftly to market changes. Additionally, the need for transparency and clear reporting to clients added complexity to their operations.

Dashboard Implementation

SecureFuture introduced a comprehensive Investment Management Dashboard that focused on key performance indicators (KPIs) such as Portfolio Performance, Risk Exposure, Asset Allocation, and Market Trends.

-

Portfolio Performance Dashboard:

- KPI: Net Asset Value (NAV) Growth: The dashboard tracked the daily, monthly, and yearly growth of the NAV for each portfolio. This helped managers quickly identify underperforming portfolios and make timely adjustments.

- KPI: Return on Investment (ROI): The ROI metric was tracked against benchmarks to assess the relative performance of each portfolio, enabling better investment decisions.

-

Risk Exposure Dashboard:

- KPI: Value at Risk (VaR): The VaR metric was monitored to understand the potential loss in portfolio value under normal market conditions. This helped in balancing risk across different asset classes.

- KPI: Beta Coefficient: By tracking the Beta, the dashboard provided insights into the portfolio's volatility compared to the market, allowing for better risk management.

-

Asset Allocation Dashboard:

- KPI: Allocation by Asset Class: This metric showed the distribution of investments across asset classes (e.g., equities, bonds, real estate). The goal was to maintain an optimal allocation that aligns with client risk profiles.

- KPI: Sector Exposure: Monitoring sector exposure helped in diversifying investments and avoiding over-concentration in any single sector.

-

Market Trends Dashboard:

- KPI: Market Sentiment Analysis: This metric leveraged sentiment analysis tools to gauge market conditions, helping managers anticipate market shifts and adjust strategies accordingly.

Outcomes

The implementation of the Investment Management Dashboard led to significant improvements in portfolio performance. The NAV growth across all portfolios increased by an average of 12% year-over-year, while ROI consistently outperformed benchmarks by 2-3%. The VaR and Beta metrics enabled better risk management, resulting in a more stable performance during market volatility. The Asset Allocation Dashboard facilitated more strategic investment decisions, ensuring portfolios remained well-diversified and aligned with client goals. Overall, the dashboard provided SecureFuture with the tools needed to enhance investment strategies, improve risk management, and deliver superior returns to clients.

2. Client Management: Improving Transparency and Satisfaction

Challenges

SecureFuture's clients range from large corporations to individual retirees, each with unique needs and expectations. The company faced challenges in maintaining transparency, providing personalized reports, and ensuring high levels of client satisfaction. Additionally, the ability to quickly address client concerns and communicate effectively was critical to retaining clients and building trust.

Dashboard Implementation

The Client Management Dashboard was designed to enhance communication, improve reporting accuracy, and monitor client satisfaction through several key metrics.

-

Client Reporting Dashboard:

- KPI: Report Accuracy: This metric tracked the accuracy of financial reports generated for clients, ensuring all data was up-to-date and error-free. The goal was to maintain a report accuracy rate of 99% or higher.

- KPI: Report Delivery Time: The dashboard monitored the time taken to deliver reports to clients after the end of each reporting period. The target was to reduce delivery time by 20%.

-

Client Satisfaction Dashboard:

- KPI: Net Promoter Score (NPS): The NPS was tracked to measure client loyalty and satisfaction. SecureFuture aimed to maintain an NPS of 50 or higher.

- KPI: Client Retention Rate: This metric tracked the percentage of clients who renewed their contracts with SecureFuture. The goal was to achieve a retention rate of 95% or higher.

-

Client Communication Dashboard:

- KPI: Response Time to Client Inquiries: The average time taken to respond to client inquiries was monitored, with a target of responding within 24 hours.

- KPI: Resolution Time for Client Issues: This metric tracked the time taken to resolve client issues or concerns, aiming to resolve 90% of issues within 48 hours.

Outcomes

The Client Management Dashboard significantly improved the company's ability to serve its clients. Report accuracy reached 99.8%, and report delivery times were reduced by 25%, allowing clients to receive timely and reliable information. The NPS increased to 55, indicating high levels of client satisfaction and loyalty. The client retention rate improved to 97%, exceeding the target and contributing to sustained revenue growth. Faster response and resolution times led to enhanced client trust and stronger relationships, further solidifying SecureFuture's reputation as a reliable and client-focused pension fund manager.

3. Compliance and Risk Management: Ensuring Regulatory Adherence

Challenges

In the highly regulated pension fund industry, ensuring compliance with local and international regulations is crucial. SecureFuture needed to manage regulatory risks, monitor compliance in real-time, and prevent any potential breaches that could lead to fines or damage to the company's reputation.

Dashboard Implementation

The Compliance and Risk Management Dashboard was developed to track compliance metrics, identify potential risks, and ensure that all regulatory requirements were met.

-

Regulatory Compliance Dashboard:

- KPI: Compliance Rate: This metric tracked the company's adherence to regulatory requirements, with a goal of maintaining a 100% compliance rate.

- KPI: Number of Compliance Breaches: The dashboard monitored any instances of non-compliance, aiming to reduce breaches to zero.

-

Risk Management Dashboard:

- KPI: Risk Assessment Score: The dashboard provided a score based on the assessment of various operational risks, helping the company prioritize and mitigate high-risk areas.

- KPI: Incident Response Time: This metric tracked the time taken to respond to compliance-related incidents, with a target of responding within 12 hours.

-

Audit Tracking Dashboard:

- KPI: Audit Completion Rate: The percentage of completed internal audits was tracked, aiming for a 100% completion rate on schedule.

- KPI: Audit Findings Resolution: The dashboard monitored the resolution of audit findings, with a goal of resolving 95% of issues within 30 days.

Outcomes

The Compliance and Risk Management Dashboard played a critical role in maintaining SecureFuture's spotless compliance record. The compliance rate was consistently maintained at 100%, and there were no reported compliance breaches over the year. The risk assessment score helped prioritize risk mitigation efforts, leading to a more secure operational environment. Incident response times were reduced to 10 hours on average, ensuring swift action on any potential issues. The audit tracking metrics ensured all internal audits were completed on time, with 98% of audit findings resolved within the targeted period. This proactive approach to compliance and risk management not only protected the company from regulatory risks but also enhanced its reputation as a trustworthy and compliant pension fund manager.

4. Human Resources and Talent Management: Fostering Employee Engagement and Development

Challenges

SecureFuture recognized that its success depended heavily on the expertise and engagement of its employees. The HR department faced challenges in retaining top talent, fostering employee development, and maintaining high levels of engagement across the organization. With a competitive market for financial professionals, it was crucial for SecureFuture to create a work environment that attracted and retained skilled employees.

Dashboard Implementation

The HR and Talent Management Dashboard was designed to track employee engagement, monitor development initiatives, and manage recruitment processes.

-

Employee Engagement Dashboard:

- KPI: Employee Satisfaction Score: This metric tracked overall employee satisfaction, with a goal of achieving a score of 8.5/10 or higher in annual surveys.

- KPI: Employee Turnover Rate: The dashboard monitored the turnover rate, aiming to reduce it by 10% over the next year.

-

Talent Development Dashboard:

- KPI: Training Hours per Employee: This tracked the average number of training hours per employee, with a target of increasing it by 20% to enhance skills and career growth opportunities.

- KPI: Leadership Development Participation: The goal was to increase participation in leadership development programs by 15%, ensuring a pipeline of future leaders within the company.

-

Recruitment Efficiency Dashboard:

- KPI: Time to Fill Positions: The average time taken to fill open positions was tracked, with a goal of reducing it by 15% to ensure timely recruitment.

- KPI: Recruitment Cost per Hire: This metric tracked the average cost of recruiting a new employee, aiming to reduce it by 10% through more efficient hiring processes.

Outcomes

The HR and Talent Management Dashboard led to significant improvements in employee engagement and development at SecureFuture. The employee satisfaction score rose to 8.7/10, indicating a positive work environment and high levels of employee engagement. The turnover rate decreased by 12%, exceeding the target and contributing to a more stable workforce. The number of training hours per employee increased by 25%, and participation in leadership development programs grew by 18%, ensuring a well-prepared and skilled workforce. The time to fill positions was reduced by 17%, and the recruitment cost per hire decreased by 11%, resulting in more efficient and cost-effective hiring processes. These improvements helped SecureFuture maintain a competitive edge in the talent market and foster a culture of continuous development and engagement.

| Previous: Creating a Portlet Dashboard | Next: Administrator Dashboard |