Report Writing Software That is Powerful and Flexible, Yet Easy to Use

Reporting has always been tightly coupled to everyday business activities. As a result, reporting requirements tend to change very often. Traditionally, when such changes occurred, you were forced to rely on developers or IT staff to revise your reports to meet the new requirements.

However, because developers often do not correctly anticipate the needs of report users, the resulting report designs are often inadequate, requiring further iteration and re-implementation.

InetSoft believes the solution to this problem is user empowerment. Instead of requiring you to communicate your needs to developers and then iterate over successive changes, Style Intelligence gives you direct access to powerful ad hoc report writing software tools that allow you to rapidly and easily design your reports yourself.

Other BI tools have previously attempted to provide ad hoc reporting. However, these tools have not reached a significant level of prevalence due to the following factors:

- Business reports are complex. Report writers are often large applications that have a steep learning curve.

- Business information is complex. Report writers often require that you understand the database query language and know how the data is stored. Style Intelligence solves both these problems. It addresses the first with an Ad Hoc tool that is lightweight, web-based, and easy to use. It addresses the second by automatically handling all the technical details of accessing data.

New Report Wizards

The Ad Hoc tool allows you to create new reports from scratch by using a step-by-step wizard. Below is a screenshot of the four different report wizards included in InetSoft's report writing software.

Chart Wizard

The chart is a widely used element in data presentation. It presents data in a graphical form and is very useful to convey implications of certain data in a succinct manner. For instance, a corporate presentation may use a pie chart to show the market share of the industry leaders. This is more easily understood than a table of numbers.

Table Wizard

A table is a standard element used in most reports to display data. You can also group the data, and calculate subtotals and grand totals. There are also Crosstab and Section Wizards which provide similar results. Learn the difference between these three and understand when to use each.

Crosstab Wizard

Crosstab is a very useful way to summarize information in a tabular format. Grouping can be done vertically and horizontally. This creates a grid of data.

Section Wizard

A Section is a very useful element in report design. A Section consists of bands. Each band is a container that holds fixed position elements. In the simplest case, a Section can display the same data as a table but give you control over the position and size of each cell. An advanced user may create a Section that contains tables and charts to create a master-detail or subreport.

Case Study: Optimizing Bitcoin Mining Operations with Report Writing Software

CryptoMine Inc. is a mid-sized Bitcoin mining company headquartered in Texas, USA. With a mining facility housing over 10,000 ASIC miners, the company generates substantial computational power to mine Bitcoin. However, the management team faced challenges in monitoring performance metrics, energy consumption, and profitability due to the complex and dynamic nature of cryptocurrency mining.

Challenges Faced CryptoMine Inc. struggled with inefficient data management and reporting processes. The key issues included:

-

Manual Data Compilation: The team relied on spreadsheets to track mining efficiency, energy costs, and hardware performance, leading to errors and delays.

-

Lack of Real-Time Insights: Mining profitability depends on multiple factors such as Bitcoin price, network difficulty, and electricity rates. The absence of real-time analytics resulted in missed opportunities for optimization.

-

Regulatory Compliance: CryptoMine Inc. needed to ensure compliance with evolving regulations on energy consumption and financial reporting.

-

Scalability Issues: As the mining farm expanded, the volume of data became overwhelming, making it difficult to extract actionable insights.

Solution Implemented To address these challenges, CryptoMine Inc. adopted InetSoft's comprehensive report writing software with data integration and real-time analytics capabilities. The key features of the software included:

-

Automated Data Collection: The software integrated with mining pool APIs, energy meters, and financial systems to gather real-time data.

-

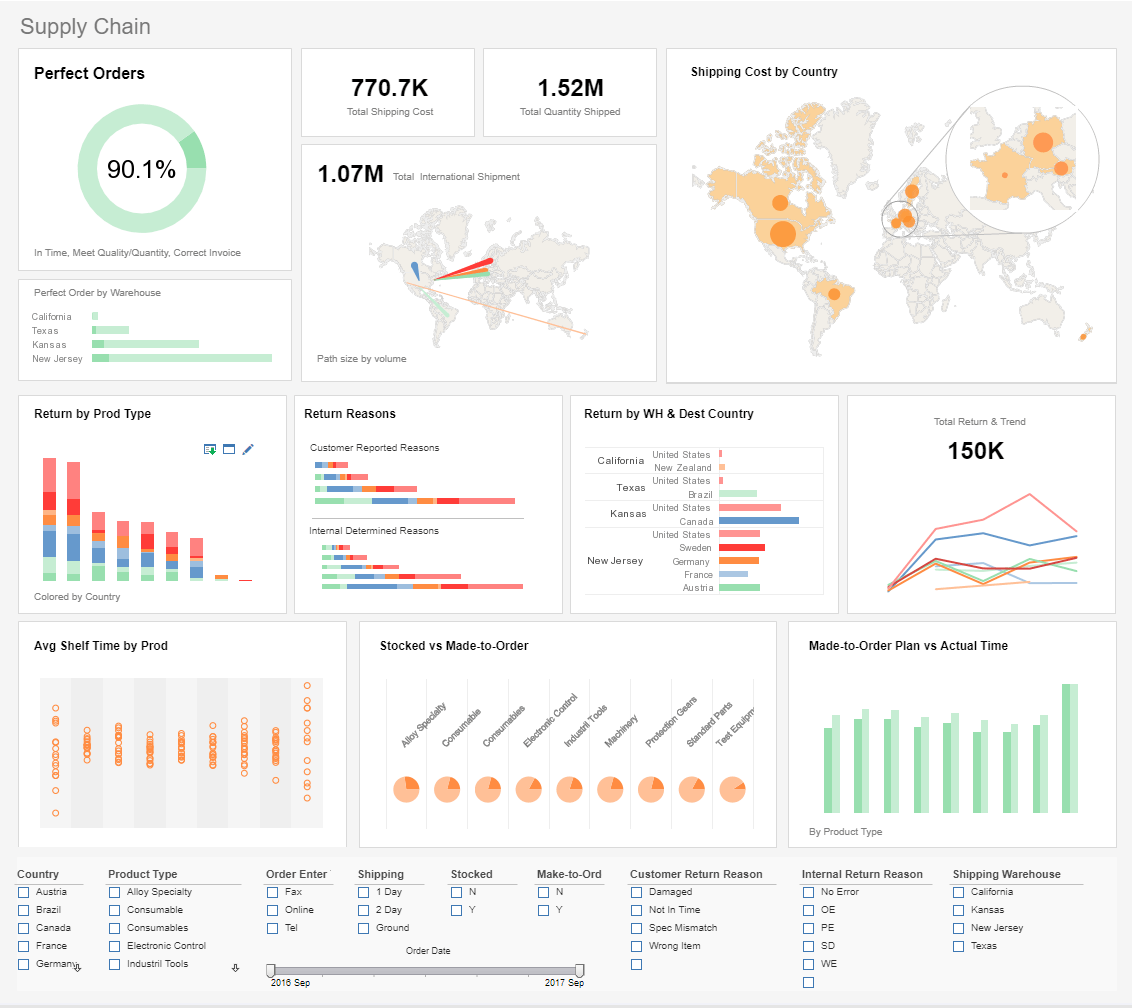

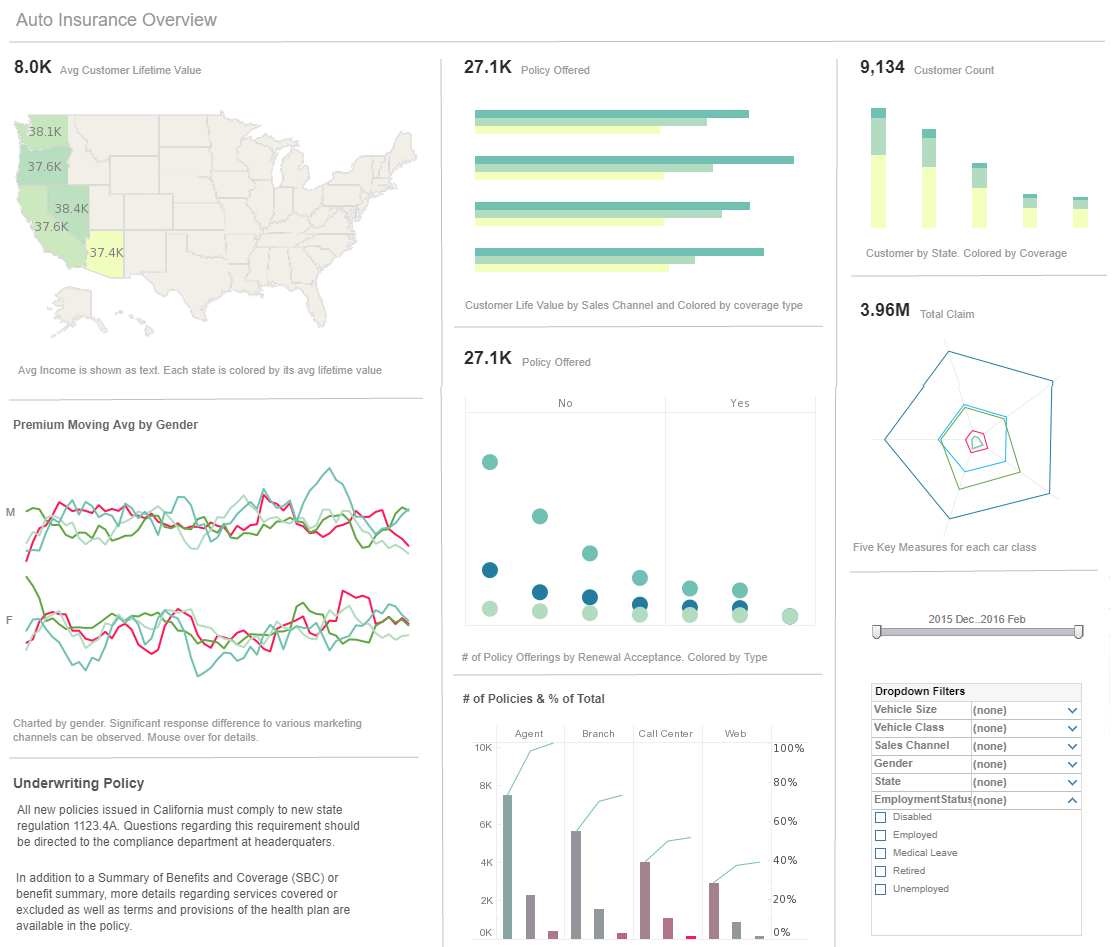

Custom Dashboards: Interactive dashboards provided an overview of mining efficiency, hardware performance, and profitability metrics.

-

Regulatory Reporting Tools: Built-in compliance reporting simplified the process of meeting regulatory requirements.

-

Scalability and Cloud Integration: The solution was cloud-based, allowing seamless scalability as CryptoMine Inc. expanded its operations.

Results Achieved The implementation of report writing software transformed CryptoMine Inc.'s operations:

-

30% Improvement in Efficiency: Automated reporting reduced time spent on data compilation and analysis.

-

Enhanced Decision-Making: Real-time insights allowed the team to optimize mining operations based on market conditions.

-

Better Compliance Management: Streamlined regulatory reporting ensured compliance with minimal manual intervention.

-

Cost Savings: Improved monitoring of energy consumption led to better cost control and increased profitability.

What KPIs and Metrics Do Bitcoin Mining Companies Use?

Bitcoin mining companies rely on several Key Performance Indicators (KPIs) and metrics to track performance, optimize operations, and ensure profitability. These KPIs cover mining efficiency, financial health, and operational sustainability. Here are some of the most important ones:

1. Mining Efficiency & Performance KPIs

- Hash Rate (TH/s, PH/s, EH/s) – The total computational power a miner contributes to the Bitcoin network. Higher hash rates increase the probability of mining new blocks.

- Block Rewards Earned – The number of Bitcoin blocks successfully mined, including transaction fees.

- Uptime (%) – Measures the operational efficiency of mining rigs. Higher uptime indicates fewer hardware failures and maintenance issues.

- Mining Difficulty – A dynamic measure of how hard it is to mine new blocks, adjusting roughly every two weeks based on network activity.

- Rejection Rate (%) – The percentage of mining shares rejected by the network, often caused by network latency or hardware inefficiencies.

2. Financial & Profitability Metrics

- Bitcoin Earned Per Day/Month – Tracks the amount of Bitcoin mined over a specific period.

- Revenue Per Megawatt (MW) of Power – Measures how much revenue is generated per MW of electricity used.

- Break-Even Hash Rate – The minimum hash rate required to cover operational costs without incurring losses.

- Profitability Index – The ratio of revenue to mining costs, indicating overall financial viability.

- Return on Investment (ROI) (%) – Evaluates how long it takes to recover capital investment in mining hardware.

- Network Transaction Fees Earned – Some miners earn additional revenue through transaction fees included in mined blocks.

3. Energy Consumption & Cost Metrics

- Energy Efficiency (Joules per TH or W/TH) – Measures power consumption per terahash, with lower values indicating better efficiency.

- Electricity Cost Per Bitcoin Mined ($/BTC) – Calculates the total electricity cost required to mine one Bitcoin.

- Power Usage Effectiveness (PUE) – Ratio of total energy used versus the energy consumed by mining hardware. A lower PUE indicates better energy efficiency.

- Carbon Footprint (CO₂ Emissions per BTC Mined) – Measures environmental impact and compliance with sustainability goals.

4. Hardware & Maintenance Metrics

- Hardware Failure Rate (%) – Tracks the percentage of mining rigs experiencing failures or needing replacements.

- Cooling System Efficiency (%) – Measures the effectiveness of cooling systems in maintaining optimal mining conditions.

- ASIC Lifespan & Depreciation Rate – Predicts how long mining equipment will remain viable before needing upgrades or replacement.

- Cost Per Miner Unit ($/Unit) – The upfront cost of each ASIC mining rig, impacting long-term profitability.

5. Market & Competitive Metrics

- Bitcoin Market Price ($/BTC) – Directly affects mining profitability, as revenue is tied to Bitcoin's price movements.

- Network Hash Rate Distribution – Identifies the miner's share of the global Bitcoin network and competitiveness.

- Mining Pool Distribution – Determines whether a company should join a mining pool for steadier payouts.

6. Compliance & Security Metrics

- Regulatory Compliance Score – Measures adherence to local and international mining regulations.

- Security Breaches & Downtime Events – Tracks instances of hacking, cyber threats, or technical failures.

- AML & KYC Compliance – Ensures mining revenues adhere to anti-money laundering (AML) and Know Your Customer (KYC) regulations.