Which KPIs to Put on an FMCG Dashboard?

It can be a pain to manage all the moving pieces of your supply chain, especially when the goods at stake fall under the fast-moving commodities category.

An FMCG dashboard is a real-time analytical tool that assists in meeting financial objectives by taking into consideration the unique requirements of popular fast-moving consumer items like food and beverages. It helps to satisfy high demand, improve purchasing and selling tactics, and cover shortages.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

Key Performance Indicators: What Are They?

All types of companies depend on key performance indicators, or KPIs, to measure their progress toward important objectives. Businesses may monitor the effects of their strategy over time and spot areas of strength or opportunity by assessing performance against KPIs. These insights are supported by real statistics rather than assumptions. The more frequently KPIs are measured, the faster firms can determine if they are off target and make necessary course corrections. KPIs enable managers to better focus their personnel's efforts and adapt if specific goals are not being met.

FMCG KPIs

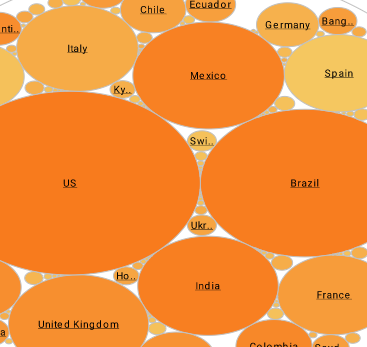

Well over half of all consumer expenditure goes into fast-moving consumer goods (FMCGs), which include snacks, soft drinks, cleaning supplies, and cosmetics. As a result, FMCG companies must keep track of a vast array of KPIs, including those specific to each product, market, and even store location. FMCG businesses also look at the supply chain that moves their products from the raw ingredients to the retailer to spot inefficiencies, expenses, and other problems. Metrics including stock levels for each store, typical time to sell, product margins, shelf exposure and availability, delivery costs, fulfillment statistics, brand preference versus competitors, as well as sustainability data are frequently included in FMCG KPIs.

These metrics are measured by a thorough study of point-of-sale statistics from stores and locations, the use of secret shoppers to take photos of goods and record their expiry dates, and data collection from every link along the supply chain. Some KPIs, like those related to sustainability, may require FMCG firms to even get in touch with the people who grow the raw materials for their products, such as coffee, tea, as well as cocoa beans. Since individual farms are frequently cut off from the companies selling their products, gathering data from this final mile of the supply chain can be difficult. This is particularly true in areas like Africa, where small - scale farmers are the majority.

5 Important FMCG Performance Indicators

1. Cycle Time from Cash to Cash

This helps you to examine and keep track of how long it takes to turn resources into cash flows. Three ratios, the days of inventory, plus the days of payables, as well as the days of receivables, are combined in this KPI. It stands for the time elapsed between when a company pays cash to vendors and when it gets cash from customers. It is helpful when determining how much cash is required to fund continuing activities and is also known as the "cash conversion cycle." Calculating the necessary finance is essential for the smooth running of fast-moving commodities. The shorter the cycle the better it is for a business. A business will function better with less capital locked up in operations if its cycle is short.

2. The Average Time it Takes to Sell

This helps answer the question: How long will it take you to sell your goods? The fast-moving consumer goods sector makes this FCMG statistic even more crucial. The Average Time To Sell is a key KPI to monitor because speed is a necessary component of this industry, which handles a lot of fresh products. The freshness varies based on the type of item (food as well as beverages, hygiene products, tobacco, home care, etc.), and it must be respected to prevent poisoning and to comply with the law. Analyzing the time it takes for your goods to sell will provide information for procurement plans and aid in inventory control. It costs money to keep products in your inventory, whether it is for labor, warehousing, or shipping. The time it takes to sell should typically be as little as feasible, i.e., you should be able to sell the majority of your goods by the short deadlines.

|

Learn about the top 10 features of embedded business intelligence. |

3. The Out-of-Stock Rate

This is abbreviated as OOS and it helps to determine your capacity to satisfy customer demand. This FMCG KPI displays the time of day and week when your inventory is depleted and the percentage of it that is unavailable. Naturally, keeping track of your stock is essential in the quickly evolving consumer goods sector. Due to the rapid sales cycle and high demand, you must have a more precise perspective of your inventory; therefore, assessing the out-of-stock rate will provide you with a significant supply-side advantage. Additionally, you should be aware that approximately 80% of "stockouts" are actually the result of poor shelf replenishment procedures; by taking the proper internal steps to restock your store's sections, you can lower the OOS rate. By doing this, you may easily avoid irate consumers who are likely to move stores as a result. Understanding the causes of inventory stockouts will help you address them more effectively and stop a problem from happening repeatedly. The typical OOS percentage for the FMCG sector is typically 8 per cent, thus it's important to keep your stockouts under this mark.

4. Percentage of Goods Sold

While Still Fresh Based on the product category, this FMCG KPI determines the proportion of your inventory that was sold before the freshness date. Statistics show that only 81.4% of the freshest things that must be sold within three days are really purchased. In reality, there is always a trade-off between the goods' shelf life and their accessibility. In fact, if you want to sell all of your goods that implies that your outlet will eventually have to cope with shelf unavailability. For this reason, many discount stores with this kind of approach are unable to give you what you need on a Saturday night, one hour before closing. Align your metric's aim with your company's strategy and what is most important: selling the merchandise by the due date or being available at all times.

|

Read how InetSoft saves money and resources with deployment flexibility. |

5. Delivered in Full and On Time

This indicator helps answer the questions: Do you get your orders exactly when you need them? Are they delivered on time or late? This is a metric used to assess delivery performance within a distribution chain. It evaluates the extent to which the agreed-upon quality criteria were met, the amount ordered, the location agreed upon, and the time anticipated by the client with a predetermined tolerance range. As a retailer, you can use this FCMG KPI to assess how well your vendors perform in terms of how frequently they deliver what you require when you require it. Take the appropriate steps to maintain your rate above 90 percent for a successful supply chain.