What KPIs and Analytics Are Used on an Integrated Receivables Dashboard?

Effective receivables management is essential to preserving stable finances and a steady cash flow. This procedure may be streamlined with the help of an integrated receivables dashboard, which offers real-time insights and facilitates data-driven decision-making.

To assist organizations, enhance their accounts receivable processes, we will examine the key performance indicators (KPIs) and analytics that are often utilized on an integrated receivables dashboard in this article.

| #1 Ranking: Read how InetSoft was rated #1 for user adoption in G2's user survey-based index | Read More |

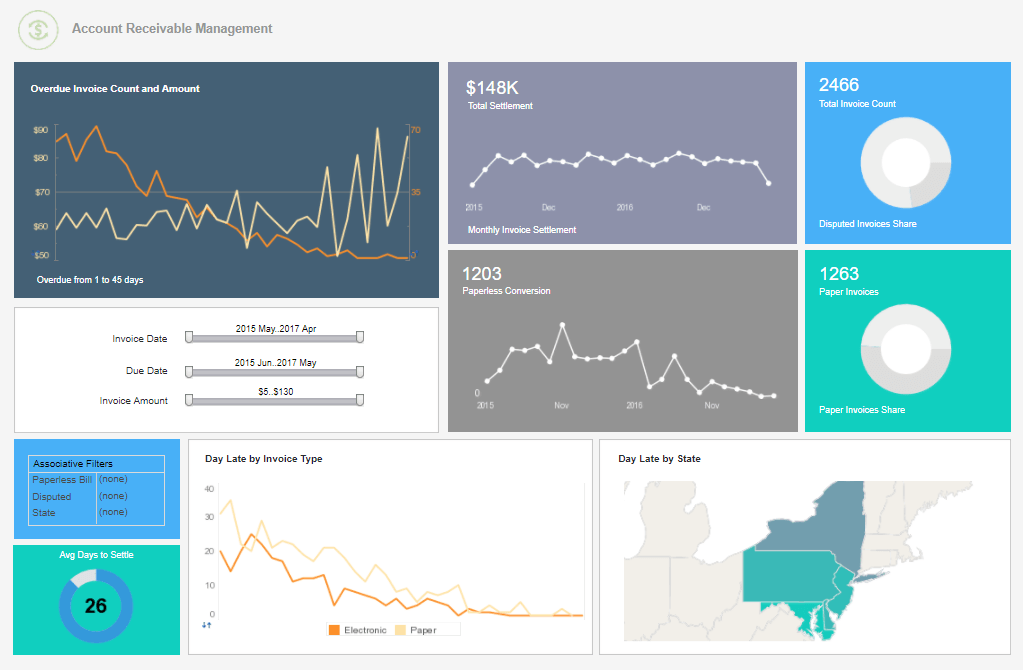

Overview of Integrated Receivables Dashboard Configurations

Integrated receivables dashboards are all-inclusive software programs that compile and provide vital data pertaining to the administration of accounts receivable. Financial professionals may monitor, evaluate, and take action on many components of the receivables process from a common hub provided by these dashboards. Now let's explore the particular KPIs and metrics that are essential to these dashboards:

Days Sales Outstanding (DSO)

To put it another way, DSO counts the typical number of days it takes a business to be paid for a transaction. Faster payment collection is indicated by a reduced DSO, which is usually good news for a business. Organizations are able to evaluate the effectiveness of their credit and collections procedures by monitoring DSO on the integrated receivables dashboard.

Aging Analysis

Aging analysis uses the number of days outstanding to classify accounts receivable balances. Receivables are usually categorized into four buckets: 0-30 days, 31-60 days, 61-90 days, and 90+ days. Businesses may use this breakdown to pinpoint past-due accounts and launch focused initiatives, including reminding customers or launching collection campaigns.

Cash Flow Forecasting

Cash flow forecasting is an essential tool for financial resource management and planning. Utilizing past payment patterns and consumer behavior, predictive analytics is often used in integrated receivables dashboards to project future cash flows. This aids businesses in making wise choices on operating cash, debt management, and investments.

Customer Payment History

Monitoring a customer's payment history gives you information about their dependability. Enterprises may mitigate risk and enhance cash flow by customizing their credit policies and collection tactics based on the assessment of customers' payment punctuality or history.

Payment Trends and Methods

Organizations may better adjust to evolving consumer preferences by analyzing payment patterns and techniques. Businesses may improve payment processing and save transaction costs by using integrated dashboards, which may contain data on the most popular payment methods used by consumers (such as credit cards, ACH transfers), as well as any changes in payment behavior.

Invoice and Dispute Analytics

Tracking invoice status and spotting disputes are common capabilities seen in integrated receivables dashboards. Organizations may improve their dispute resolution procedures and avoid cash flow interruptions by keeping an eye on the quantity, kind, and settlement timeframes of conflicts.

Credit Risk Assessment

Efficient management of accounts receivable depends on the assessment of credit risk. To assess a customer's creditworthiness, integrated dashboards might use credit scoring algorithms and information from credit bureaus. Credit choices, changes to credit limits, and the setting of payment conditions are all influenced by this data.

|

Learn about the top 10 features of embedded business intelligence. |

Collection Effectiveness

Key performance indicators (KPIs) for collection efficacy, such as the proportion of accounts receivable collected and the success of collection activities, assist companies in assessing the work of their collection's teams. With integrated receivables dashboards, businesses can monitor their progress in lowering past-due accounts and set priorities for their collection efforts.

Metrics for Early Payment and Discounts

To encourage clients to pay their bills on time, several companies provide incentives for early payments. The usage of these discounts and their effects on cash flow and consumer behavior may be evaluated using integrated dashboards.

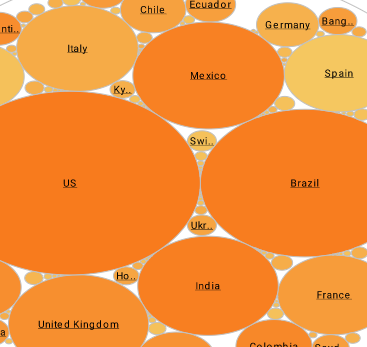

Customer Division

Customer segmentation is the process of grouping consumers according to a variety of factors, including size, industry, and payment habits. Organizations may improve cash flow by customizing their credit, collections, and communication methods to each group's specific requirements via customer segmentation.

Invoice Turnover Ratio

The invoice turnover ratio calculates the speed at which a business receives payment for its invoices in a specified time frame. The average accounts receivable amount is divided by the total credit sales to arrive at this figure. Increased turnover ratios are a sign of effective credit and collection procedures.

|

Read the top 10 reasons for selecting InetSoft as your BI partner. |

Bad Debt Percentage

The proportion of outstanding accounts receivable that is unlikely to be collected owing to non-payment or default is known as the bad debt percentage. Businesses may evaluate the success of their credit risk assessment and collections efforts by keeping an eye on this KPI.

Customer Satisfaction Scores

Customer satisfaction rankings reflect how happy consumers are with the way they are invoiced and paid for products. Customer input may be gathered and analyzed using surveys or other feedback techniques that are linked into the dashboard. This enables firms to make the required modifications.

Payment Trends by Region or Industry

Companies with a wide range of clientele could examine payment patterns according to sectors or geographical areas. This information may be used to pinpoint strategies for various client groups by identifying variances in payment behavior that are sector- or geography-specific.

Payment Predictions

By using previous data, advanced analytics and machine learning algorithms may be utilized to forecast future payment behavior. Proactive collections planning may be aided by predictive models on the dashboard, which can predict which bills are likely to be paid on time and which may encounter delays.

|

View the gallery of examples of dashboards and visualizations. |

Automated Cash Application Accuracy

Accurate automated cash applications are crucial for businesses that handle a lot of transactions. This KPI evaluates the degree to which payments are automatically matched to invoices, eliminating mistakes and requiring less human reconciliation work.

Customer Communication Effectiveness

Integrated dashboards may monitor consumer outreach initiatives, such phone calls or email reminders, and assess how well they work to speed up payments. Based on these data, businesses might modify their communication methods.

Rolling Cash Flow Forecast Accuracy

This KPI assesses how accurate rolling cash flow projections are over time. Companies may evaluate how well projected cash flows match actual cash flows to improve future estimates and resource allocation. It is used to develop long-term strategies to maximize their cash flow management.

Transaction Discrepancies and Errors

Monitoring inconsistencies and mistakes in transactions helps in detecting systemic problems that can be resulting in payment delays or disagreements. Improving client relations and streamlining payment procedures are two benefits of resolving these problems.

Supplier Discount Capture Rate

This KPI calculates the proportion of qualifying discounts that consumers actually use when firms provide supplier discounts for early payments. A high capture rate is a sign of well-managed discounts.

|

Learn how InetSoft's data intelligence technology is central to delivering efficient business intelligence. |

The Advantages of an Integrated Receivables Dashboard with KPIs and Analytics

After discussing the key KPIs and analytics found on an integrated receivables dashboard, let's examine the advantages that these measurements provide to companies:

1. Improved Cash Flow Management

Through efficient DSO monitoring, aging analysis, and cash flow forecasting, businesses may maximize their cash flow management. Through proactive measures to detect bottlenecks and regions of delayed payments, organizations may expedite collections and sustain a robust cash flow.

2. Enhanced Customer Relationships

Businesses may customize their consumer interactions by using segmentation statistics and customer payment history. By catering to the unique requirements of valuable clients or providing flexible payment terms to devoted patrons, personalization may enhance customer relationships.

3. Risk Mitigation

Dashboards for integrated receivables provide improved monitoring and evaluation of credit risk. Businesses may reduce possible losses and decide on loan limits and conditions through early detection of high-risk clients or developing credit concerns.

4. Cost Reduction

Cost savings might result from an analysis of payment patterns and procedures. For instance, a company might bargain with payment processors for lower transaction costs if a sizable portion of its clientele favors a certain mode of payment, or it can make technological investments to expedite that mode of payment.

5. Efficient Collections

Effectiveness of collection Dispute analytics and KPIs facilitate the optimization of collections procedures. This effectiveness may save operating expenses, lighten the burden on collections staff, and increase the chance of collecting unpaid accounts.

6. Strategic Decision-Making

Having access to extensive data and analytics on the integrated dashboard facilitates the process of making strategic decisions. These insights may help businesses establish realistic goals, improve credit practices, and coordinate their accounts receivable approach with overarching financial objectives.

|

Learn the advantages of InetSoft's small footprint BI platform. |

Challenges and Considerations

Although integrated receivables dashboards provide many advantages, there are drawbacks and things to think about as well:

1. Data Accuracy

It is crucial that the data put into the dashboard is accurate. Data errors or inconsistencies might result in inaccurate findings and poor decision-making. To guarantee data accuracy, regular procedures for data validation and reconciliation are necessary.

2. Integration with Existing Systems

It might be difficult to integrate the receivables dashboard with current financial systems. During implementation, compatibility problems, data transfer difficulties, and the need for staff training must be addressed.

3. Data Security and Compliance

Securing sensitive financial data requires strict adherence to data protection laws and security protocols. Companies need to make cybersecurity investments and make sure their dashboard complies with industry-specific compliance guidelines.

4. Cost of Implementation and Maintenance

Even if an integrated receivables dashboard has several advantages, companies still need to take into account the initial setup and maintenance expenses. Planning your budget is crucial to ensuring a profitable return on investment.