What Are the Metrics Tracked on a Financial Advisor Dashboard?

A modern financial advisor dashboard distills dozens of data points into a handful of high-impact metrics that answer three core questions: How healthy is the practice? How are client portfolios performing? And where should we take action next? Below are the most useful metrics, what each one means, and practical levers an advisory firm can use to influence them.

Assets Under Management (AUM)

What it means: The total market value of client assets the firm manages. AUM is the single most common headline metric—many fees and firm valuations are tied to it.

How to affect it: Grow AUM by acquiring new clients, increasing existing clients’ asset levels (through cross-selling or capturing household assets), and improving investment performance to reduce outflows. Retention-focused client service and targeted marketing to high-net-worth prospects are high-leverage tactics.

Net New Assets (NNA)

What it means: New inflows minus outflows over a period. NNA shows whether the business is expanding organically or shrinking.

How to affect it: Run referral campaigns, simplify transfer and onboarding processes, and create targeted campaigns for rollover windows (e.g., retirement distributions, corporate events). Monitor reasons for outflows—pricing, service, or investment performance—and address the root cause.

Revenue (Total and by Source)

What it means: Total fees, commissions, and other revenue. Breakdowns (advisory fees, performance fees, commissions, recurring vs non-recurring) tell you how predictable and scalable the business is.

How to affect it: Shift toward recurring fee models if predictability is a goal. Introduce packaged service tiers, implement value pricing for planning services, and upsell additional services (tax planning, estate planning) to increase per-client revenue.

Revenue per Client / Revenue per Advisor

What it means: Average revenue generated per client or by each advisor—useful for benchmarking productivity and profitability.

How to affect it: Increase by focusing advisors on higher-value clients, improving client segmentation, or automating low-value work so advisors spend time on revenue-generating activities. Train advisors in consultative selling to expand wallet share.

Client Acquisition Cost (CAC)

What it means: Total marketing and sales spend divided by the number of new clients acquired. CAC informs marketing ROI and payback period.

How to affect it: Lower CAC with referral programs, content marketing that attracts inbound leads, and partnerships. Improve lead qualification to avoid wasting resources on low-probability prospects.

Client Retention Rate / Churn

What it means: Percentage of clients retained over a period (or the inverse: churn). High retention is often more profitable than constant acquisition.

How to affect it: Improve onboarding, regular proactive communication, meaningful annual reviews, client education, and tracking of client satisfaction (see NPS). Fix the friction points that cause exits—billing complaints, performance, or poor service responsiveness.

Read how InetSoft saves money and resources with deployment flexibility.

Average Account Size & Household Penetration

What it means: Average dollar value per account and the degree to which all household assets are consolidated under the advisor.

How to affect it: Conduct householding reviews, offer incentives or service bundles for moving additional accounts, and present holistic financial plans that reveal gaps the advisor can fill.

Portfolio Performance vs Benchmark

What it means: Investment returns for client portfolios compared to relevant benchmarks (after fees). This measures value delivered by the investment strategy.

How to affect it: Improve asset allocation discipline, manage costs (lower expense ratios, minimize turnover), rebalance regularly, and tailor benchmarks to client objectives. Communicate performance in context—volatility, drawdowns, and risk-adjusted returns matter as much as raw return.

Risk Metrics (Beta, Standard Deviation, Drawdown)

What it means: Measures of portfolio volatility and downside risk. These ensure portfolios align with client tolerance.

How to affect it: Reassess client risk profiles, diversify across uncorrelated assets, use hedges where appropriate, and implement guardrails or automated rebalancing to limit drift during market swings.

Asset Allocation & Drift

What it means: The planned vs actual allocation across equities, fixed income, cash, alternatives. Drift measures how far portfolios have moved from target.

How to affect it: Automate rebalancing, set tolerance bands, and schedule periodic reviews. Educate clients on the rationale for rebalancing to reduce resistance.

Pipeline Metrics (Leads, Conversion Rate)

What it means: Number of active prospects, conversion rate from lead to client, and time in funnel. These forecast future AUM and revenue.

How to affect it: Improve lead quality, shorten response times, implement repeatable discovery processes, and track which marketing channels convert best so you can reallocate spend.

Client Satisfaction / NPS

What it means: Net Promoter Score or other satisfaction measures that predict referrals and retention.

How to affect it: Collect feedback routinely, act on it, and close the loop with clients. Train staff on empathy and responsiveness. Use survey results to identify systemic issues.

Operational Metrics (Time-to-Onboard, Compliance Incidents)

What it means: How long it takes to open a new account, complete KYC/AML checks, and how many compliance breaches or incidents occurred.

How to affect it: Streamline onboarding with digital forms and e-signatures, integrate third-party KYC tools, and enforce clear documentation and training to reduce compliance risk.

Profitability & Expense Ratios

What it means: Gross and net profit margins, and operating expense per advisor or per client.

How to affect it: Increase fees where justified, migrate to higher-margin services, reduce cost with automation (CRM, billing, reporting), and outsource non-core tasks. Track fixed vs variable costs to understand scalability.

Accounts Receivable / Days Sales Outstanding (DSO)

What it means: How quickly clients pay invoices—important for cash flow management.

How to affect it: Offer clear billing schedules, automate invoicing, provide multiple payment options, and introduce late-fee policies or incentives for timely payment.

“We evaluated many reporting vendors and were most impressed at the speed with which the proof of concept could be developed. We found InetSoft to be the best option to meet our business requirements and integrate with our own technology.”

- John White, Senior Director, Information Technology at Livingston International

Advisor Productivity (Meetings, Hours, Billable Time)

What it means: Number of client meetings, hours spent on advisory work, and portion of time that is billable or revenue-generating.

How to affect it: Remove administrative burden with an ops team or automation, batch administrative tasks, set client meeting cadences, and evaluate whether lower-value clients should be moved to a lighter service tier.

Compliance & Risk Controls

What it means: Indicators such as policy breaches, disclosures filed, or audit findings that reflect regulatory health.

How to affect it: Maintain up-to-date policies, run frequent internal audits, invest in compliance training, and use technology to flag suspicious activity automatically.

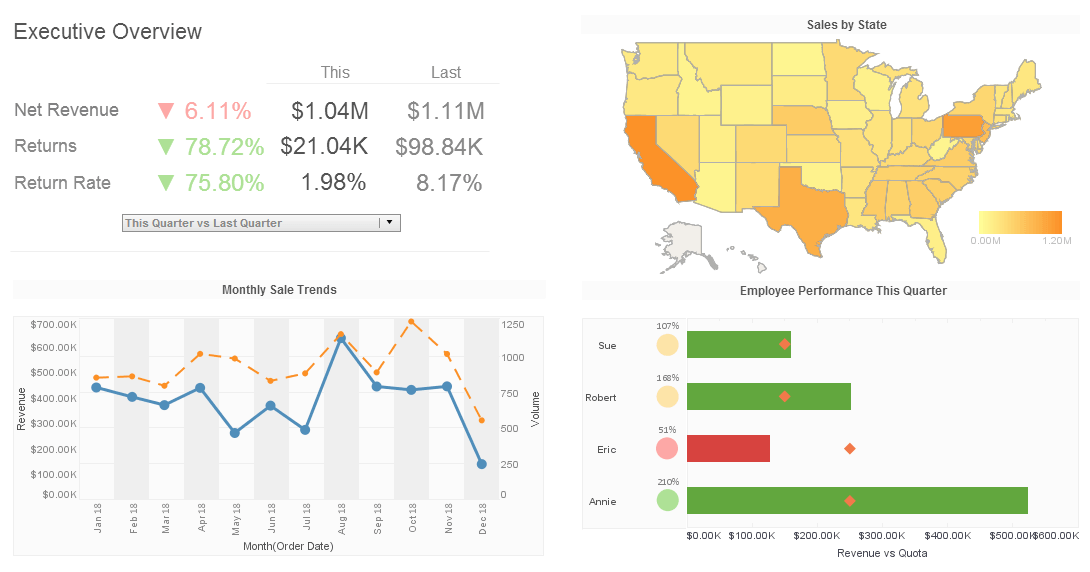

Putting Metrics Together: dashboards that drive action

Metrics are powerful only when they’re connected to clear actions. A strong dashboard groups metrics by theme—growth, client experience, investment performance, and operations—then surfaces recommended next steps (e.g., “follow up with 10 high-value prospects in the pipeline,” “rebalance 35 accounts exceeding drift threshold,” “audit onboarding process with >10 day cycle time”). Real-time data combined with trend views (30/90/365 days) and segmentation (by advisor, client segment, or AUM bucket) turns raw numbers into prioritized work for the team.

Finally, remember that the best dashboards balance business and fiduciary goals. AUM growth matters, but so does delivering appropriate risk-adjusted returns and excellent client service—metrics should drive decisions that align the firm’s incentives with client outcomes.