Data Intelligence for Banking

The integration of financial data, taking into account the large volume of data, security restrictions, and time sensitivity is an exceptionally complex process. On top of data, intuitive visualization, reporting and machine learning are must-haves to extract the maximum amount of information.

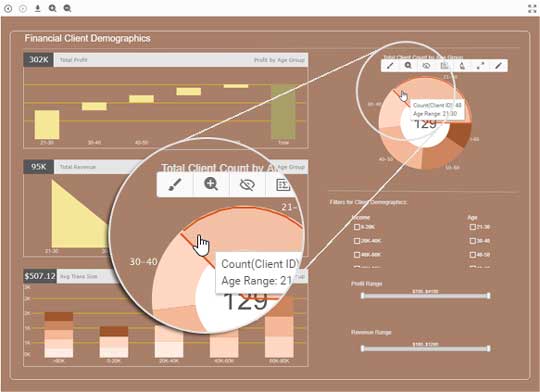

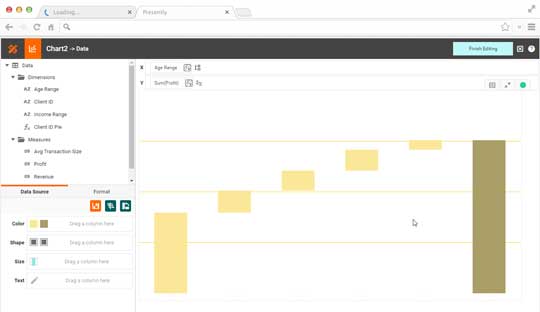

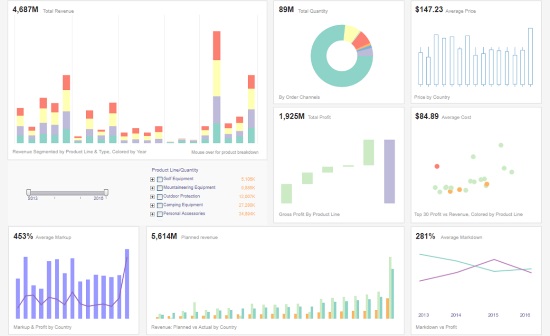

Visual Analytic Dashboards for Banks

InetSoft has proven experience serving banking institutions and partnering with solution providers focused on financial service verticals. The company's full range of enterprise reporting and business intelligence features provides a powerful tool set for the financial industry.

In contrast to other banking BI applications that provide only reporting, or only dashboards, or require an intermediate data access layer, InetSoft's business intelligence system is complete. It includes analytics software and sophisticated reporting capabilities plus direct access to almost any data source.

Spotlight on Portfolio Performance Management

Asset management is a rapidly growing area for investment and retail banks alike. Managing a complex security instrument portfolios and providing accurate, numerous client reports, in addition to supporting real-time information access, quickly become a daunting challenge. Combining InetSoft's powerful visualization dashboard technology, report bursting, and ad hoc reporting, this complex business process can easily be broken down into automated tasks, client self-service tasks, and IT professional-driven tasks.

Asset allocation strategies are adjusted frequently in accordance with rapidly changing market conditions. Identifying risk levels and analyzing asset allocation for a large number of clients in a timely fashion can place extreme demands on company resources. InetSoft's sophisticated visualization software and dashboards, when directly linked to a transactional database, drastically reduce the complexity of this business process.

Other Sample Financial BI Applications

- Fraud alert and notification of unusual transactions

- Sales and marketing analysis

- Risk and credit control

- Multi-dimensional analysis to identify market trends

- Automated compliance reporting

Some of InetSoft's Customers in the Financial Industry

- CitiGroup

- Credit Suisse

- Deutsche Bank

- JP Morgan Chase

- Macquarie